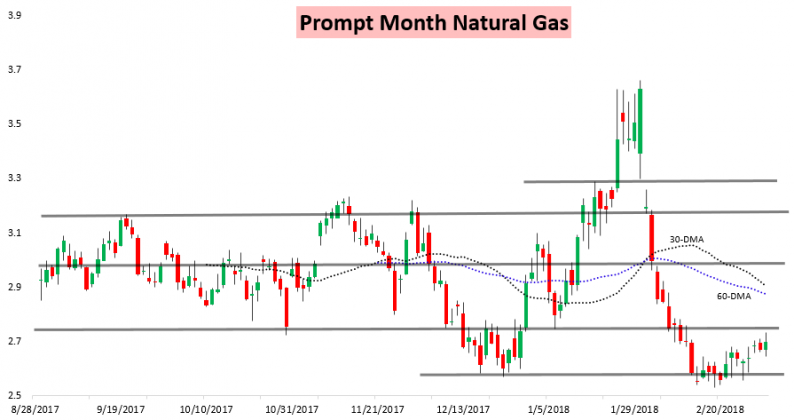

March natural gas prices settled up a bit more than a percent on the day following an EIA print that came in right at expectations.

The EIA announced a net implied flow of -78 bcf, which was a withdrawal significantly larger than for the same week last year but much smaller than the 5-year average.

This fit perfectly with our expectations, though this confirmation we saw as slightly bullish, which we notified our clients of immediately following the print. Prices then dipped a bit initially after but rose into the afternoon.

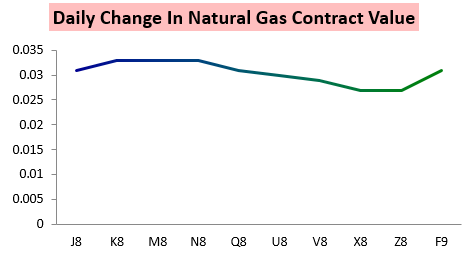

By the end of the day, though, it was clear the print was supporting prices, with the entire natural gas strip up solidly.

The data release was also able to induce enough volatility briefly that the 5 and 10-day average trading ranges both ticked higher, though not by all that much.

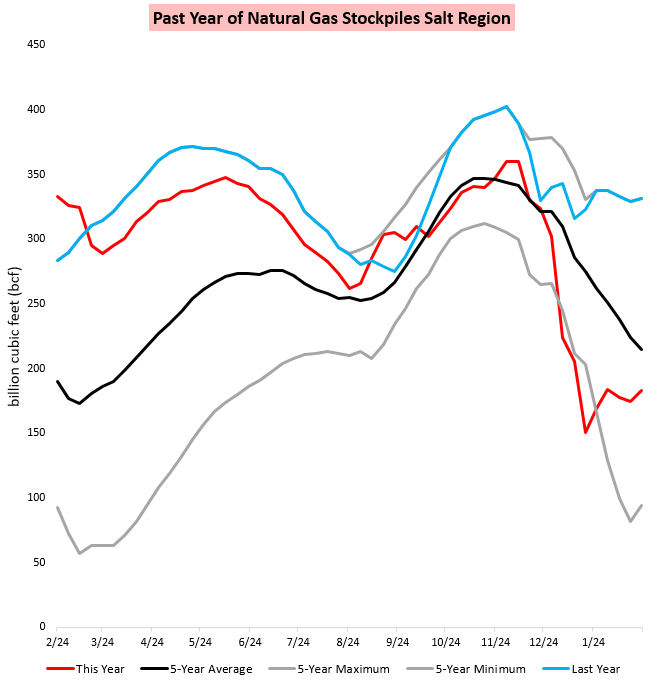

Looking closer into today’s release, while much of the country withdrew gas last week, salt caverns across the South actually injected gas back.

This comes after Salts were significantly depleted in the heart of winter, when cold dove significantly into the South.

Of course, storage levels nationally still remain significantly below the 5-year average, though they closed the deficit again with today’s print.

Leave A Comment