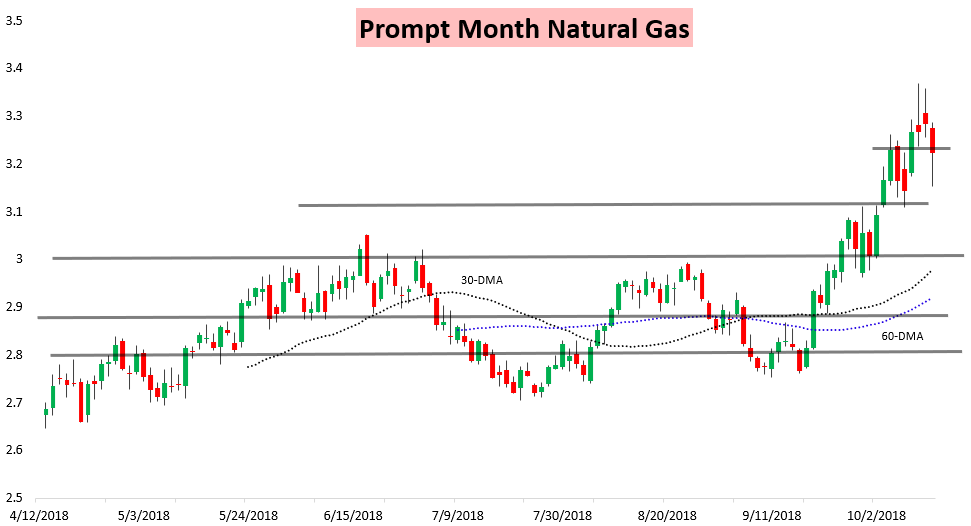

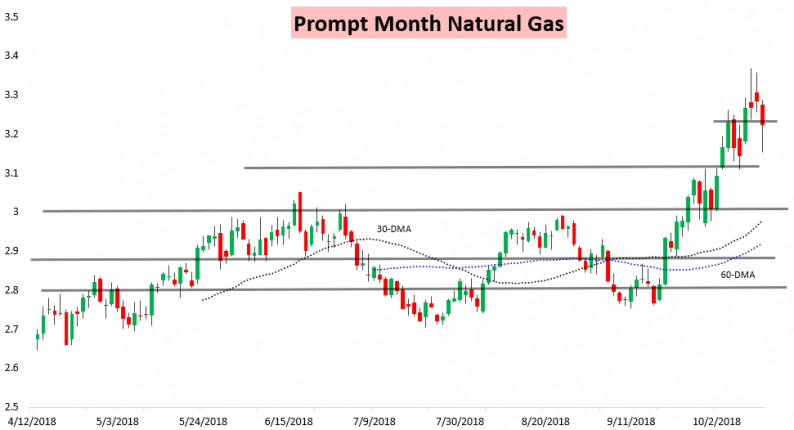

Natural gas volatility seems here to stay, with weaker cash prices and a bearish EIA print hitting prices today before more bullish weather trends helped reverse the natural gas futures curve into the settle. The end result was a loss of around 2% for the November natural gas contract.

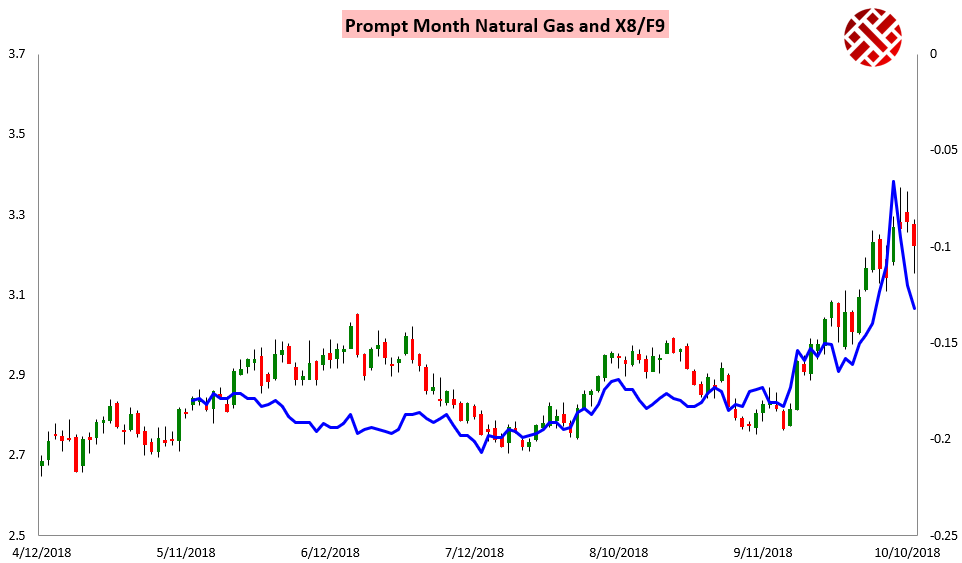

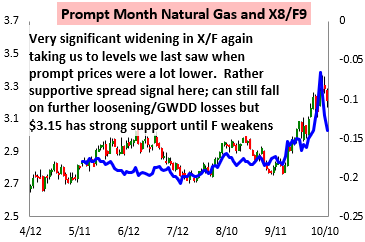

Again losses were most significant at the front of the strip, with continued November/January widening.

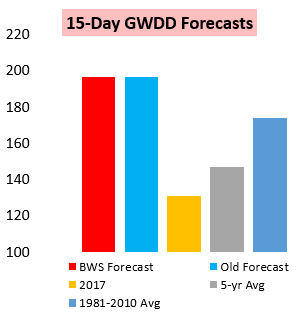

Futures initially declined this morning on weaker physical prices as well as weather forecasts that were no more impressive.

Our Morning Update held “Slightly Bearish” sentiment, as did our Afternoon Update yesterday, as we looked for a looser EIA print and looser balances to hit natural gas prices today.

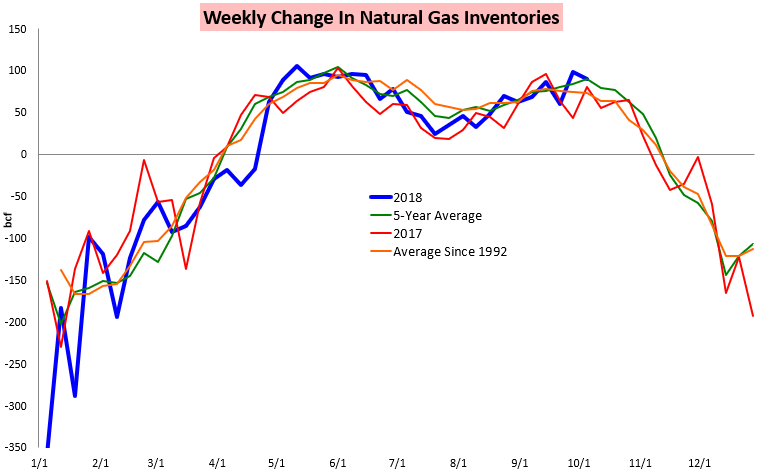

Our sentiment turned in this direction partly because we saw today’s EIA print as quite likely to be bearish, or looser on a weather-adjusted basis to previous prints. The EIA announced that 90 bcf of natural gas was injected into storage versus our estimate of 92 bcf, but still close enough to confirm our reading of the print.

Prices accordingly dipped into and again a bit after the print. After the print we first released our EIA Rapid Release showing our latest weather-adjusted balance readings to last year and the 5-year average while also explaining how we expected prices to react to the number. We followed that up with our intraday Note of the Day, where we looked at weather-adjusted balances and the spread reaction to the number. This led us to conclude that downside to $3.15 existed short-term but support should hold.

Sure enough, the November natural gas contract set a daily low at $3.153 right around noon Eastern. Prices then reversed off that into the settle on colder afternoon model guidance.

Leave A Comment