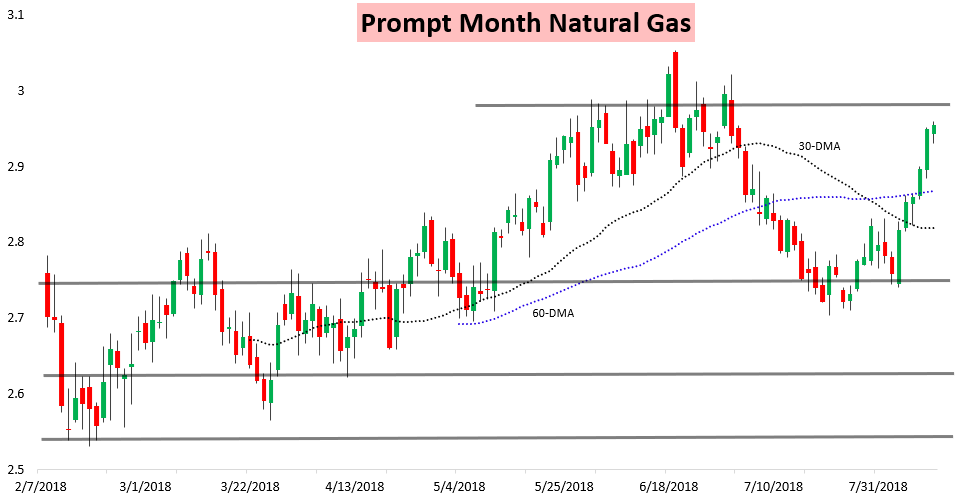

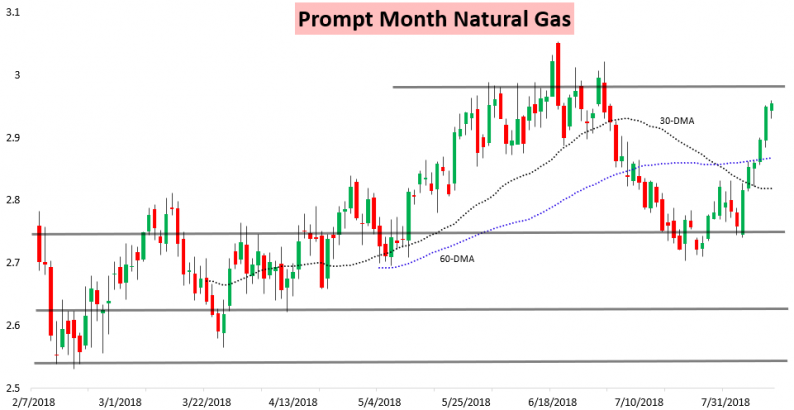

The September natural gas contract settled just a few ticks higher on the day following an EIA print that generally fit the consensus heading into the day but continued to show a tight natural gas market.

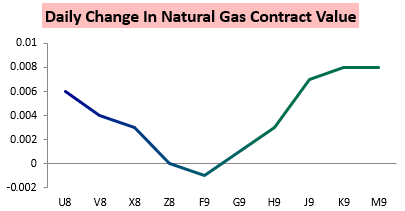

It was an unusual day along the natural gas strip as well, as into the end of the day we saw the front of the strip bid up but the winter strip weaker. The Spring 2019 strip saw even more strength than the front, however!

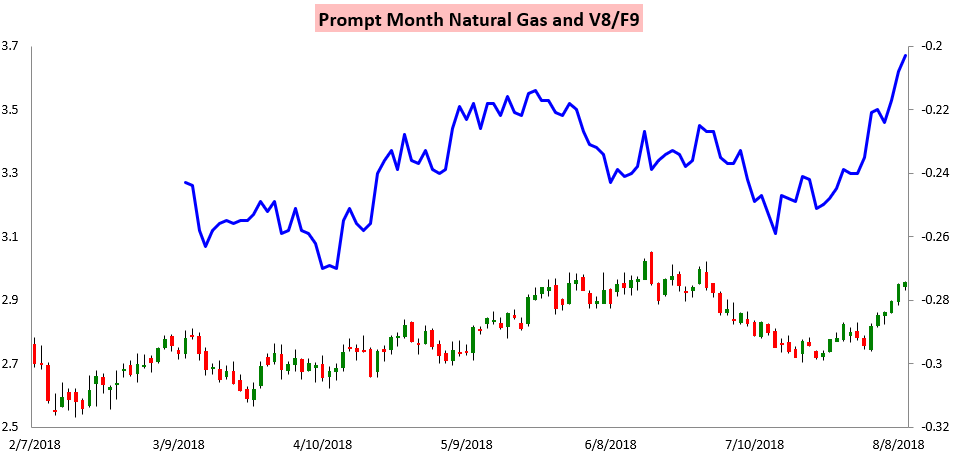

The result was a strange day where the V/F October/January spread narrowed.

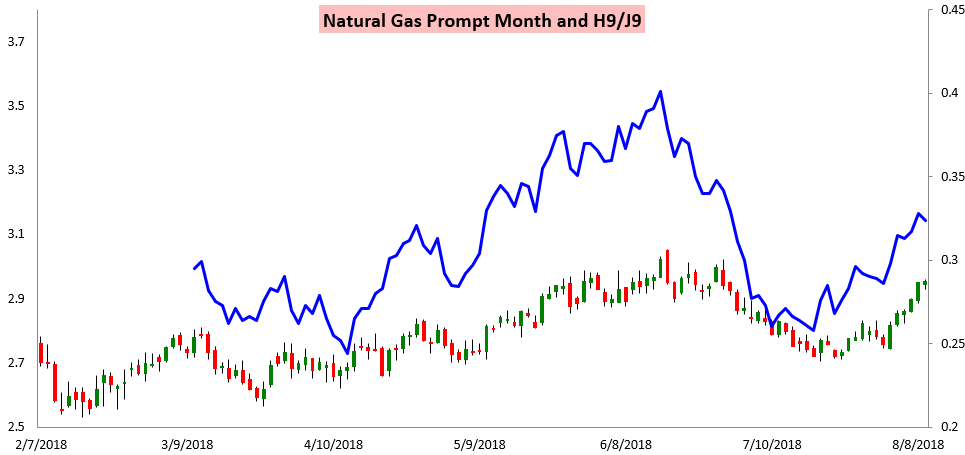

Yet the H/J March/April spread came in a touch.

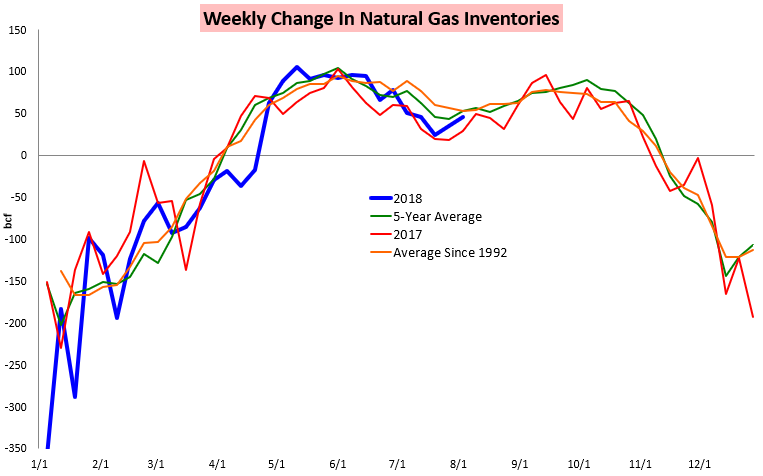

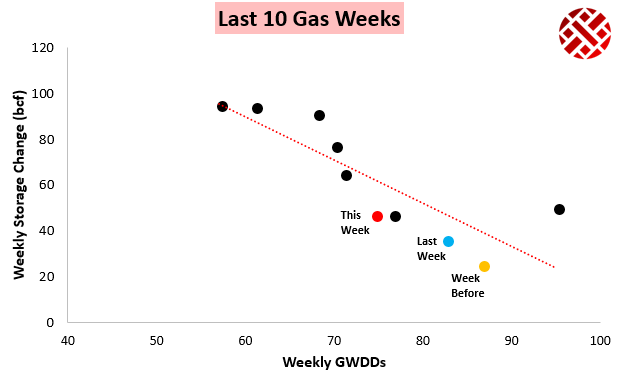

All this came after the EIA announced a 46 bcf injection into storage last week, coming in just slightly below our 50 bcf estimate and right in line with most analyst expectations.

The print fits in well with the last few prints as well in terms of tightness, as the market has tightened up significantly through the summer.

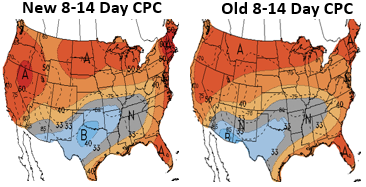

Meanwhile, weather models this afternoon moved right towards our expectations we had been warning our clients about the last few days. This helped keep a relative cap on prices, and we see the Climate Prediction Center still keeping some cooler risks across the South in the long-range.

We had a very busy day today, with our Morning Update outlining our expected price action into and after the EIA print and our EIA Rapid Release explaining how the print impacted our current reading of supply/demand balance and how prices should react through the day. Our intraday Note looked closer at Week 2 and 3 forecasts and weather-adjusted burns to predict price action into the weekend, and our Afternoon Update summarized 12z weather model guidance trends, looking at how models should change overnight and how prices should move into the AM session.

Leave A Comment