Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it.

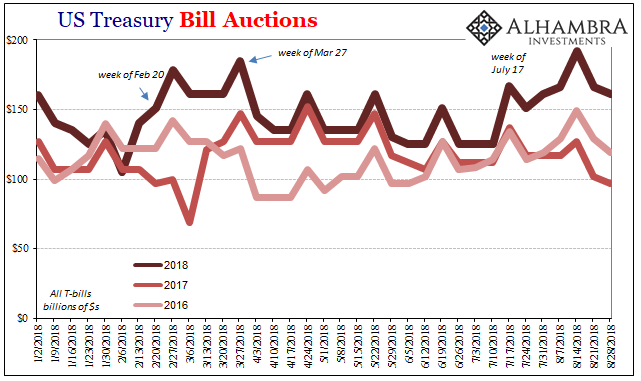

The Treasury Department announced yesterday that it will be auctioning off $65 billion in 4-week bills this week (today). The results showed that dealers submitted $152 billion in bids, with $38 billion being accepted. This is supposed to represent a substantial money market hardship according to the mainstream theory established earlier this year.

Since mid-July, the government has unleashed another T-bill deluge, most of which has fallen to the 4-week instrument. To give you a sense of the difference, for the auction that took place on July 10, a mere seven weeks ago, Treasury offered only $35 billion. Dealers submitted $92 billion worth of tenders, and won on $20 billion.

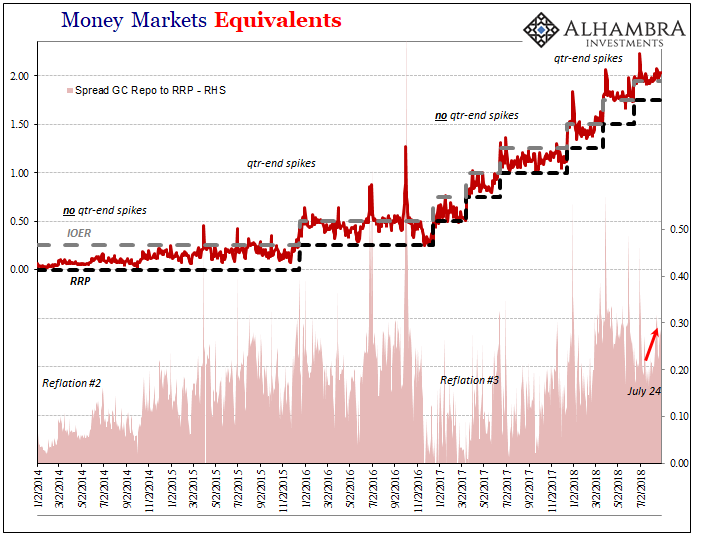

If you recall the earlier explanation (lie), officials contended that this greater burden for dealer financing this swelling bill inventory meant stress in the repo market. Sure enough, since August 9, the GC rate for UST collateral is up again. It’s not yet nearly as far above RRP or EFF as it was before, but the rate is moving in that direction.

From there we are supposed to accept the pull of repo rates on EFF even though that is entirely backward. Setting aside first anything about T-bills and deficits, everyone just breezes past that major upset.

This is not how it is supposed to work – unsecured rates are not supposed to be at best steady below those of secured arrangements (how can it cost you so much more to borrow with security than without?) It’s a sign of the times and everything that is wrong with the monetary system that central bankers will only ignore for as long as they have handy scapegoats.

For one thing, the Treasury Department’s bill mania has had nothing whatsoever to do with past anomalies. Repo rates tend to get very noisy around quarter ends, but only those quarters which exhibit outside monetary irregularities (deflationary characteristics). Those quarters in which reflation is the dominant trend demonstrate no such tendencies.

Leave A Comment