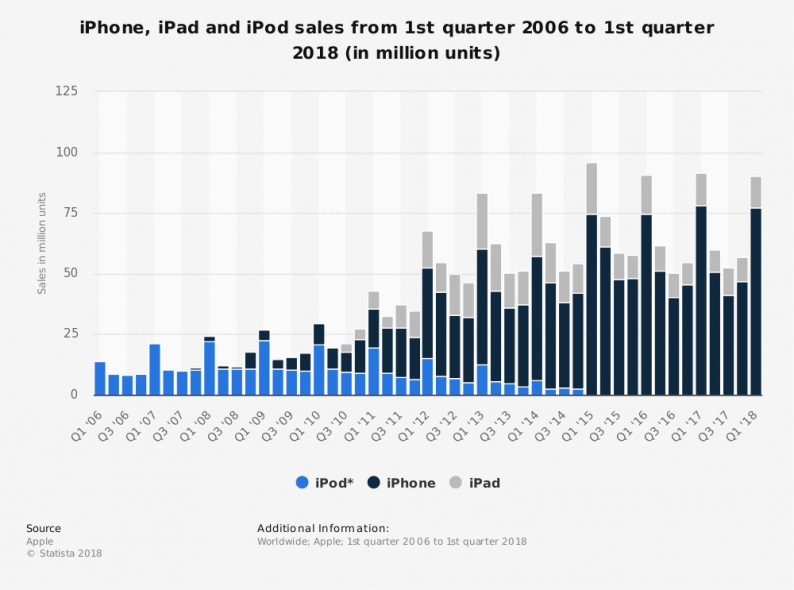

This week the great tree of Apple (AAPL) finally stopped growing toward the sky. During its latest quarter, in fact, i-Pad sales were down 25%, Mac volume came in 4% lower and even the i-Phone barely breached the flat line.

In all, Apple’s mighty machine of double digit growth posted a revenue gain of just 1.7% over prior year, while its net income was essentially flat. The real news, however, was that management is now projecting an actual 11% y/y decline in sales during the current quarter.

Don’t get me wrong. Apple has been the most awesome fount of product invention, global production and supply chain proficiency, logistics and marketing innovation and consumer brand value creation in modern history—perhaps ever.

Its products—especially the smart phone—did fundamentally transform the daily life of the world. Apple’s installed base of one billion devices is a living testimonial to its fanatical focus on bringing to the consumer a truly transformative digital age experience.

Yet it all happened in well less than 10 years. Indeed, while the tech world was booming in the 1990s, APPL was struggling. Between 1990 and 2004, revenue grew at only 4% per annum and earnings did not increase by one thin dime.

That’s right. Apple’s net income stalled out at $500 million per year for a decade and one half—or at a level equal to two days profits during the quarter just reported.

That wasn’t much to write home about under any circumstance, but was especially wimpy compared to Microsoft (MSFT), where sales and net income grew at a 27% CAGR during that period; or Cisco, where sales and earnings soared by 50% annually for 15 years running.

And that brings us to the lunatic valuation of the FANGS, which was also on display again this week, and why 100X+ PE multiples are always and everywhere a deformed artifact of central bank driven Bubble Finance, not the emission of an honest capital market.

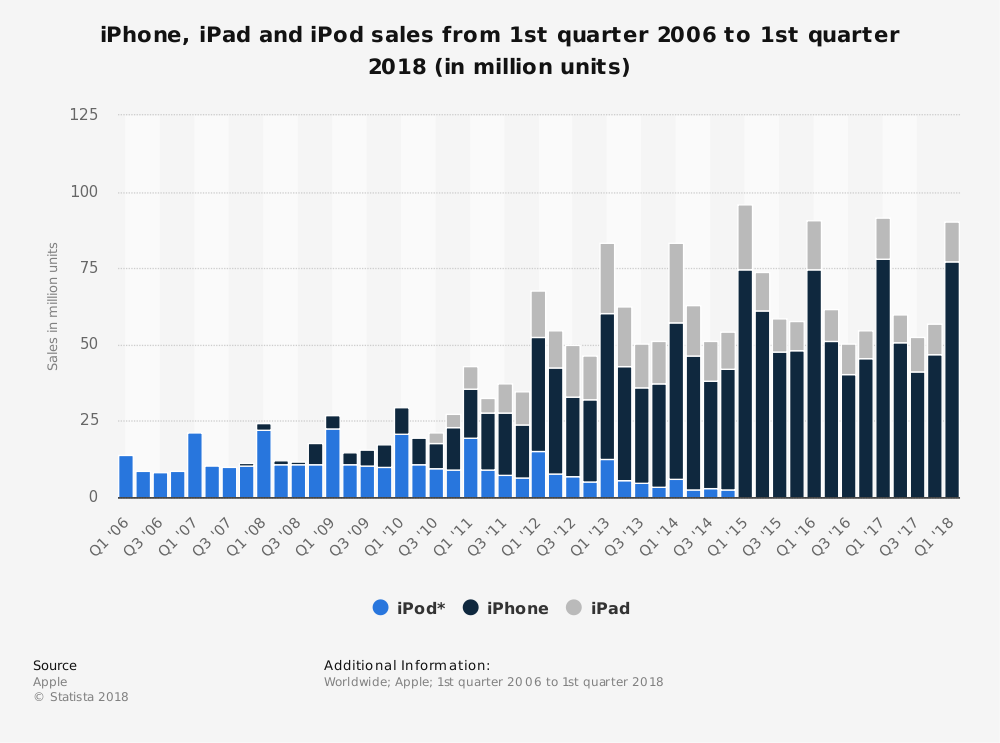

The fact is, the greatest technology-based businesses of modern times accomplished its dramatic growth spurt in just over 20 quarters between 2011 and 2015. That was after the i-Phone incepted and the i-Pad worked up a serious head of steam.

Now Apple is pan caking or worse, and it is hard to believe that gimmick products like Apple Watch or Oculus can fill the hole from the fast fading i-Pad and the stalling i-Phone. No harm done, of course, and its entirely possible the APPL will have another modest growth run.

But here’s the thing. Apple essentially proves you can’t capitalize anything at 100X except in extremely rare cases because of the terminal growth rate barrier. That is, after a few years of red hot growth almost every large company’s organic growth rate bends toward the single digit path of GDP.

In this respect, Microsoft and Cisco (CSCO)surely prove the rule. After their blistering 1990’s growth, the were valued at 75X and 230X reported earnings, respectively, at the tech bubble peak in 2000. But the terminal year growth rates implied in those towering multiples were not to be——even for two of the most inventive companies of the digital age.

During the last fifteen years, Microsoft’s net income has grown at a 5.9%annual rate and Cisco’s at 7.8%. Technology shifts, competition and global macroeconomic trends together conspired to bend their red hot growth trajectories toward the flat line.

Leave A Comment