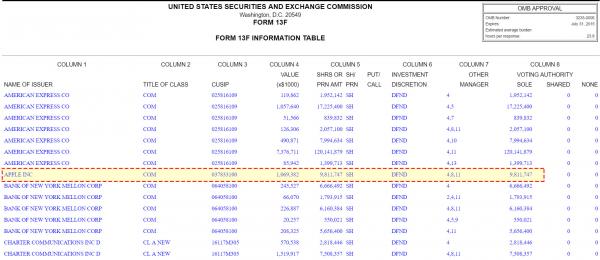

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. There was some confusion as to why the jump and then it was revealed that none other than that “other” billionaire, Warren Buffett, has decided to start building a stake in the world’s biggest cell phone company to the tune of 9.8 million shares or about $1.07 billion as of March 31.

Making some more sense of the transaction, CNBC adds this was not a direct Buffett purchase – who has previously announced he “does notunderstand tech” – but one made by one of his two lieutenants.

The 9.8 million share position makes Buffett the 56th largest holder of AAPL, still well behind the Swiss National Bank, which as we reported last week was aggressively buying AAPL stock in Q1, adding some 4.1 million shares to its now record 14.5 million share holding in the tech company.

And so with Carl Icahn’s “no brainer” trade in AAPL being unwound in late April, it appears that in addition to the SNB, the other major counterparty who was buying Carl’s shares was none other than folksy uncle Warren.

Considering that the news comes days after it was announced that Buffett is also seeking to get involved in the Yahoo financing, one wonders if Berkshire has changed its bankers in recent days and is now being advised to buy into “growth” and tech companies.

Or maybe, with Buffett also adding to his investment in money-losing IBM, perhaps Buffett’s entire philosophy on investing has been flipped on its head and he is simply hoping to piggyback on what until recentl was Icahn’s trade, namely to buy up just companies that have the balance sheet capacity for billions in stock buybacks in a world devoid of organic growth.

Leave A Comment