Apple (AAPL) is a widely followed and much-debated stock. However, investors, financial analysts, and the media tend to put too much attention on the details when discussing Apple, and they often overlook the big picture.

Many analysts focus on the latest news and data points, trying to estimate to the second decimal place how many iPhones the company will sell in a particular quarter. However, the big picture is much more important than the small details, and missing the forest for the trees is a very common mistake when it comes to analyzing Apple stock.

The following paragraphs will be taking a look at Apple stock from a quantitative perspective, centering the analysis on four particularly important return drivers: Financial quality, valuation, fundamental momentum, and relative strength.

Impressive Financial Quality

Apple has one of the most valuable brands in the world, and the company’s customers are notoriously loyal to its products and services. Brand differentiation, a strong cultural footprint, a reputation for quality, and a deep focus on design allow Apple to charge above-average prices for its products, which also means superior profitability for the company.

Most companies in the consumer electronics industry struggle to make any money nowadays, while Apple generates outstanding profitability levels. According to data from Canaccord Genuity, Apple has a market share of 18% in smartphones based on unit sales for the fourth quarter of 2017, but the company retains an impressive 87% of all profits generated in the smartphone industry.

The chart below shows key profitability metrics such return on assets (ROA), return on equity (ROE), return on investment (ROI), gross margin, net margin, and operating margin for Apple vs. the average company in the industry. The company is clearly superior to the average industry player by a wide margin.

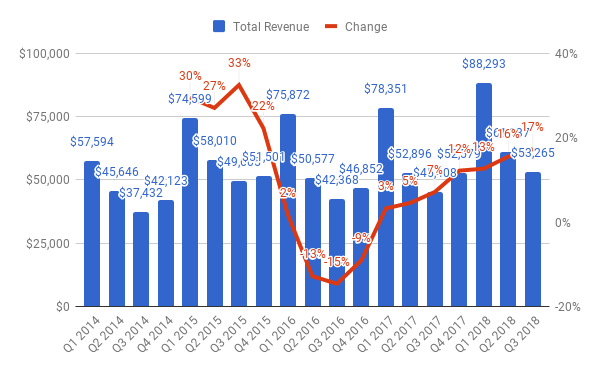

It can be challenging for such a massively big company to find new growth opportunities that are big enough to move the needle in terms of global financial performance. However, Apple has still managed to deliver accelerating revenue growth in every quarter since the third quarter of fiscal year 2016.

Revenue in the iPhone segment grew 20% year over year last quarter. Unit sales increased by only 1%, but Apple realized a huge increase of almost 20% in the average selling price for the iPhone during the quarter.

In times when most smartphone manufacturers are aggressively competing on price to sustain market share, Apple is flexing its competitive muscle and realizing much higher prices for its products. The fact that customers are willing to pay higher prices for the iPhone while other players are offering plenty of lower-priced devices speaks volumes about the value of the Apple brand and the loyalty of its customer base.

Leave A Comment