April started with a bang.

The market is showing some considerable signs of increasing volatility, which could be quite sudden some of the times, not to mention surprising.

Over the past few weeks, there’s been a series of events, some of them caused by geopolitics, others caused by trading relations uncertainty, and others caused by technology advancing or security issues.

The CBOE Volatility Index (VIX) is clearly showing proof that volatility is back. Are you not entertained?

VIX – Weekly Chart

VIX – Technical Analysis:

All this translates into volatility and wild swings, but what about the charts? What can the charts indicate?

Elliott Wave – Technical Analysis

Dollar Index (DXY) – 2H Chart

DXY – Wave Analysis:

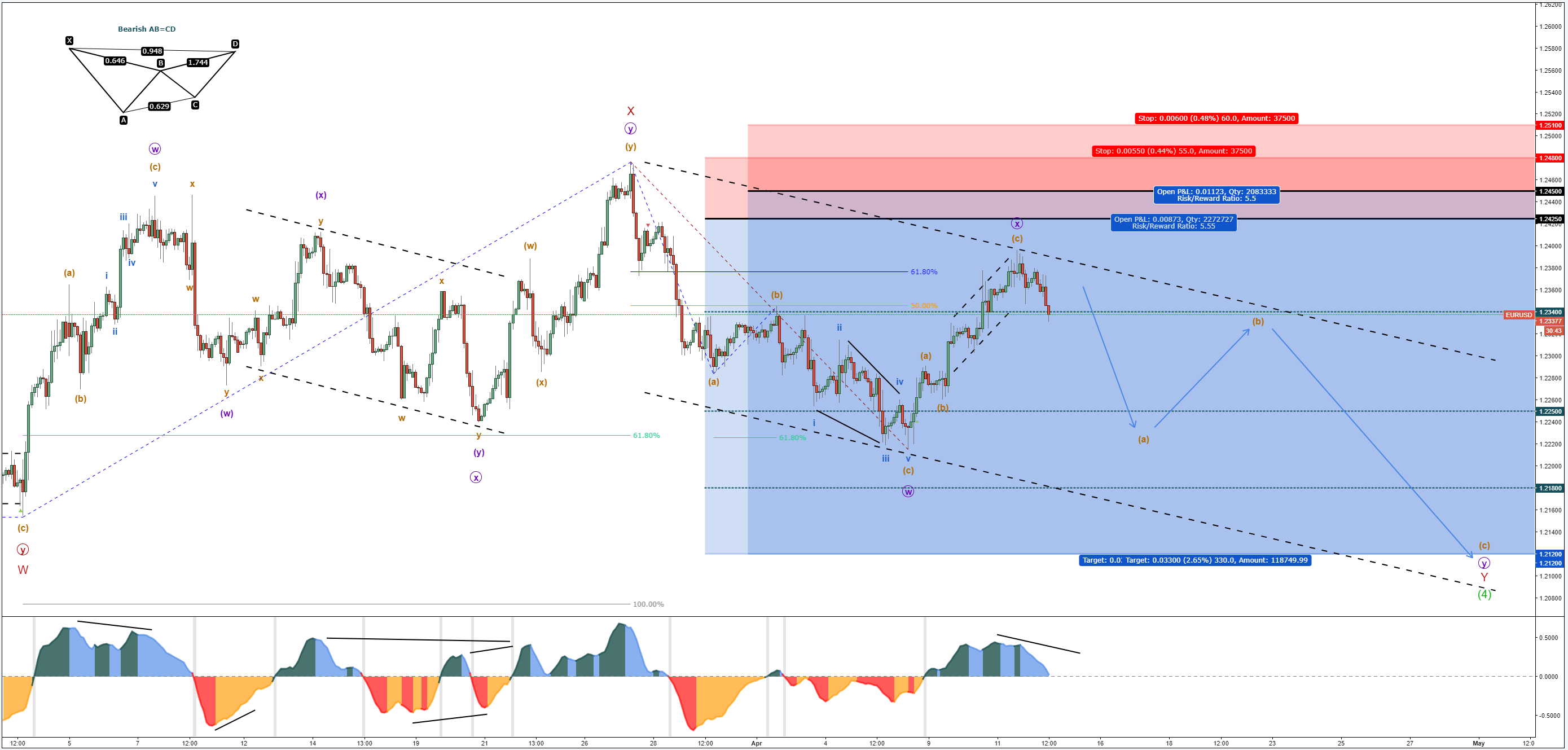

EUR/USD – 2H Chart

EUR/USD – Wave Analysis:

GBP/USD – 2H Chart

GBP/USD – Wave Analysis:

XAU/USD – 2H Chart

XAU/USD – Wave Analysis:

XAG/USD – 2H Chart

XAG/USD – Wave Analysis:

Crude Oil (WTI) – 2H Chart

Crude Oil (WTI) – Wave Analysis:

Leave A Comment