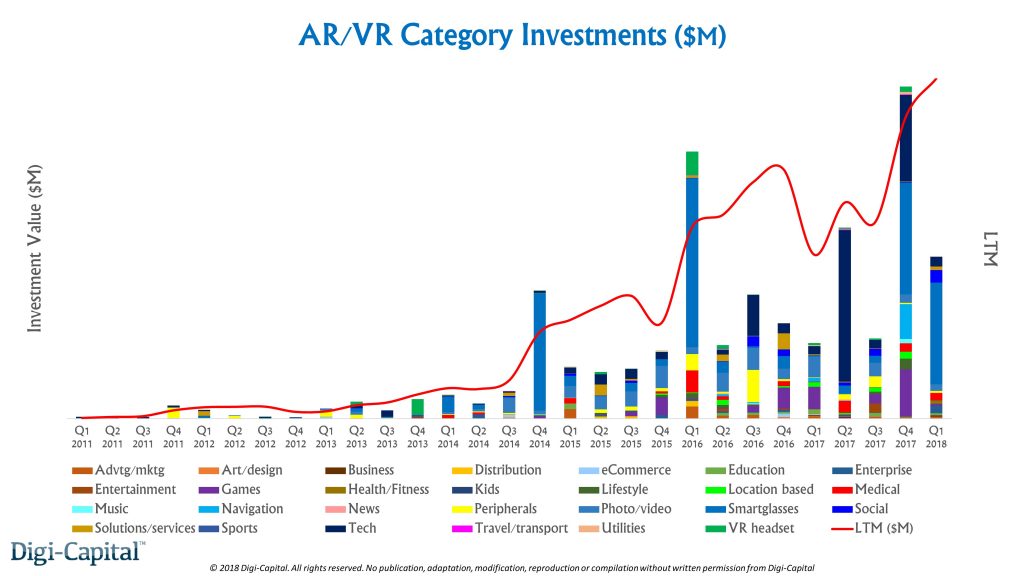

AR/VR startups raised a record over $3.6 billion from VCs and corporates in the last 12 months to the end of Q1 2018. Over three-quarters of a billion dollars was invested in the first 3 months of this year alone. A fundamental transition in the fundraising market towards AR from VR, as well as the very early-stage dynamics of mobile AR, are driving an acceleration of fundraising trends we anticipated at the start of the year. As expected in a transitional year, overall deal volumes declined slightly in the short-term as VCs and corporates look to medium-term mobile AR and long-term smartglasses growth.

Augmenting the bank account

The investment dollar figures for the last 12 months and first quarter are impressive, but digging beneath the surface reveals what is really going on. As has become more expected in early-stage tech markets, mega-rounds take the lion’s share of dollars invested. In the last 12 months Magic Leap raised nearly $1 billion ($502 million in Q4 2017 and $461 million in Q1 2018), Improbable raised $502 million, Niantic raised $200 million and Unity did another big round.

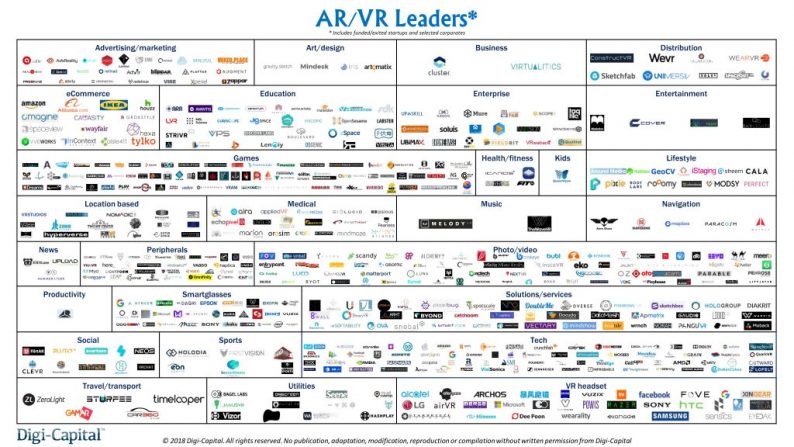

While the 5 largest deals took half the money, smaller companies have been quietly augmenting their coffers. The pun is intentional, as the trend at the start of the year has been for investors to favor AR across many of the 28 AR/VR investment sectors. In contrast, VR startups have found the fundraising environment more challenging.

By investment sector, AR/VR tech took one-third of investment dollars, followed by smartglasses at a similar scale. AR/VR games, navigation, medical, social, photo/video, and peripherals were also significant. Smaller sectors by funds raised were AR/VR lifestyle, location-based, entertainment, enterprise, VR headset, education, advertising/marketing, music, solutions/services, health/fitness, business, video, utilities, news, eCommerce, travel/transport, art/design and sports.

Steady as she goes

Leave A Comment