Good Monday morning and welcome back. Based on early indications, it appears that the bears may be trying to get something going to the downside here. Everybody knows that the current trend is stretched to the upside and that the market is overbought. As such, some downside exploration would certainly make sense right about now. But before we wander too far down the prognostication trail, let’s start the week off with an objective review my key market models and indicators – to make sure we recognize what “is” happening in the market.

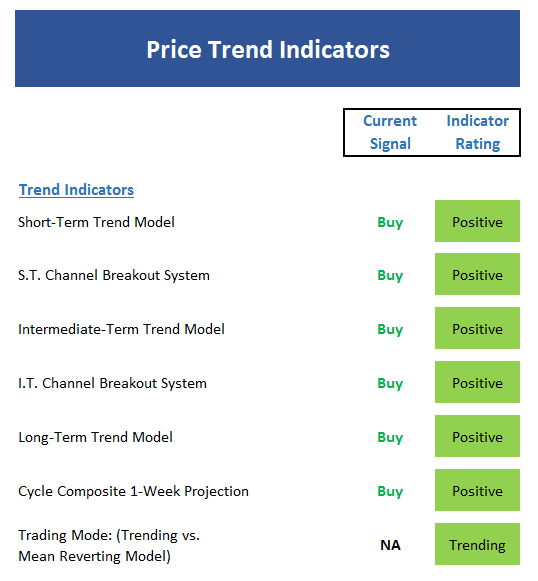

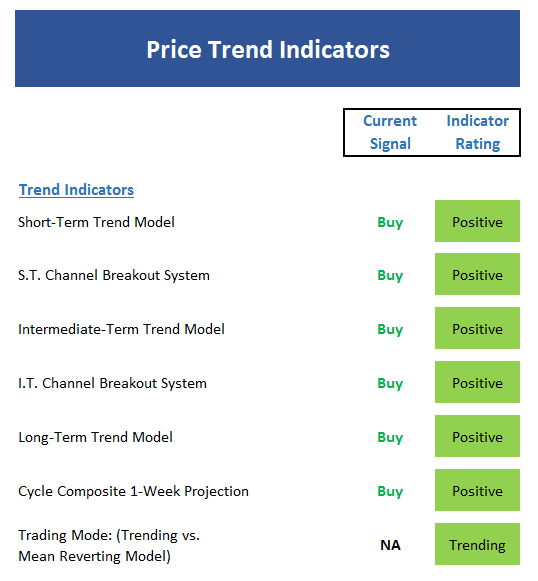

The State of the Trend

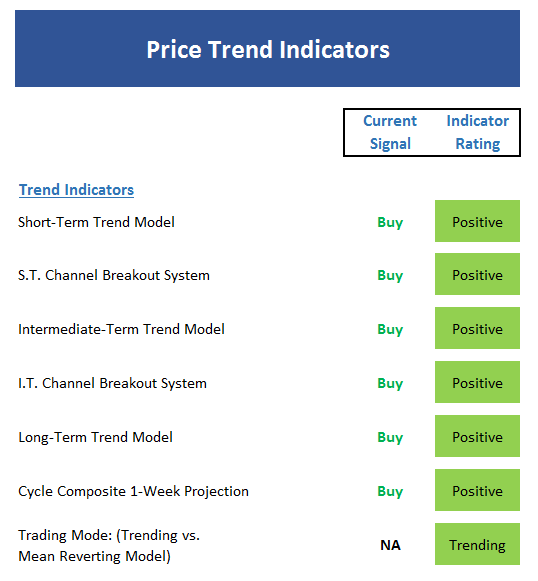

We start each week with a look at the “state of the trend” from our objective indicator panel. These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

The short-term trend model remains positive, but bears will likely attempt to make a stand here.

The short-term channel breakout system is positive above S&P 2350

The weekly trend remains strong

The intermediate-term channel breakout system is positive above 2270

The cycle composite is positive this week but then points to a stair-step pullback into mid-April

The market is currently “trending” and you don’t need fancy math to confirm

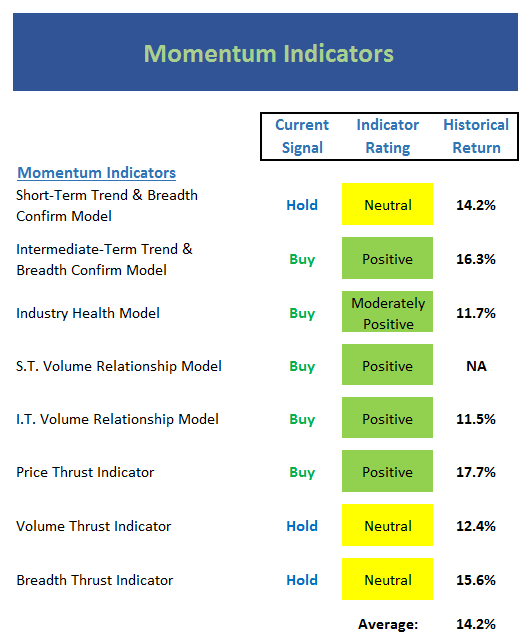

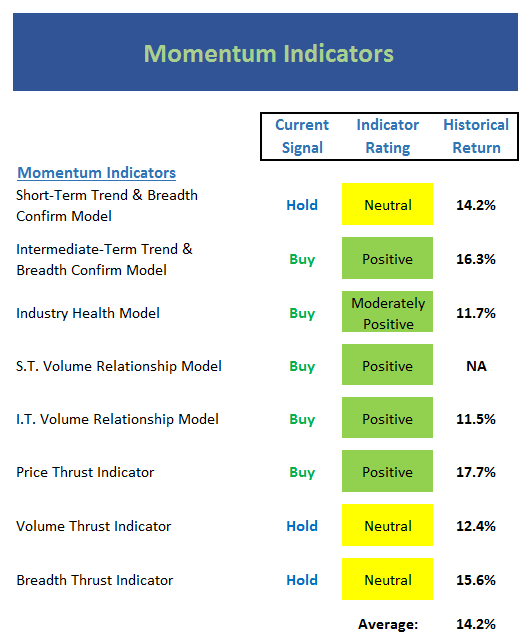

The State of Internal Momentum

Now we turn to the momentum indicators…

Executive Summary:

The short-term Trend & Breadth Confirm model is neutral. For me, this is the first warning sign.

However, the intermediate-term T&B Confirm model is solidly positive

The Industry Health model is STILL not outright positive. This is also a warning sign.

The short-term Volume Relationship model is positive, but not super strong at this time – this indicates a tired market trend.

The intermediate-term Volume Relationship model is solid as a rock

The Volume Thrust indicator is providing conflicting signals here. The indicator is neutral but still has strong historical return readings. But, this indicator should be better here.

Ditto for the Breadth Thrust indicator. This combo is a third warning sign.

Leave A Comment