Quotable

“Soon you will be where your own eyes will see the source and cause and give you their own answer to the mystery.”

? Dante Alighieri, Inferno

Commentary & Analysis

Are Comdols in the cross-hair if oil prices see $35?

Based solely on our wave analysis, the short answer is yes.And near-term, the price action today in iron ore, copper, and gold isn’t helping commodity currencies (even though the rest of the majors are doing well against the dollar).

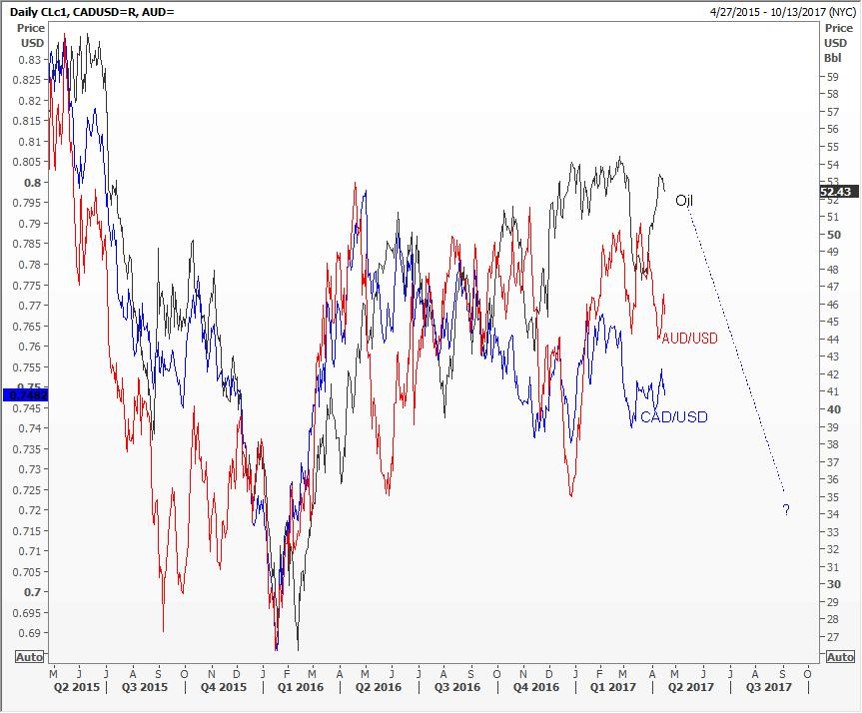

It seems the most accurate correlation for the commodity currencies remains oil prices.We are expecting oil to see $35 before it goes higher; that is likely not good for commodity currencies.Of course the big assumption here, or elephant in the room, is the US dollar.If our oil guess proves true, it means the US dollar is ramping up again.And a stronger dollar pressures commodities across the board.

Crude Oil Futures (WTI): Targeting down to $35 per barrel and wondering how this might not only hurt commodity currencies, but emerging market currencies and add to worries about the House of Saud.

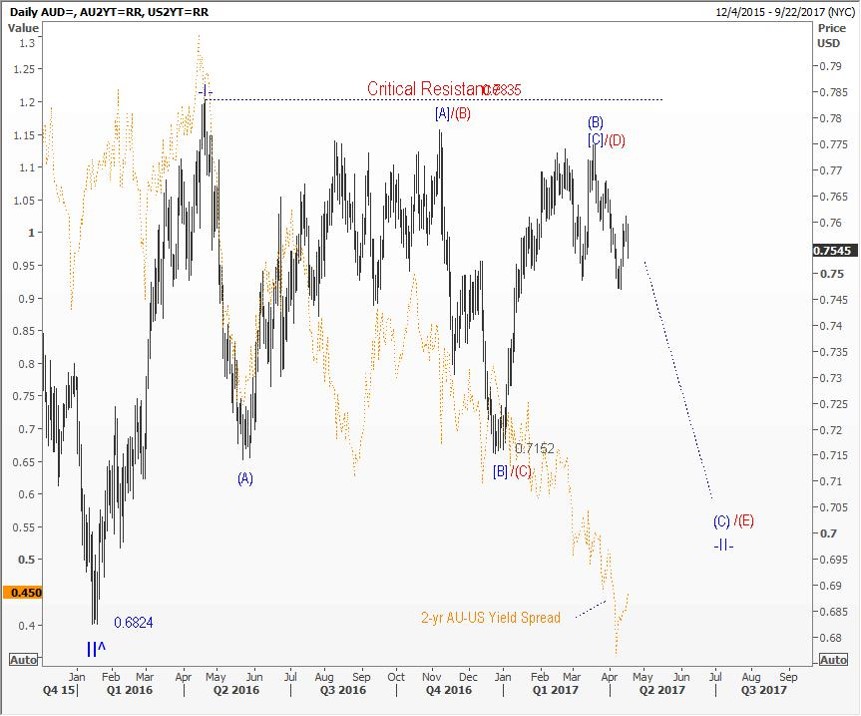

Australian dollar (AUD/USD) vs. Australia-US 2-yr Yield Spread Daily: Looking for a move to the 0.7000-level…

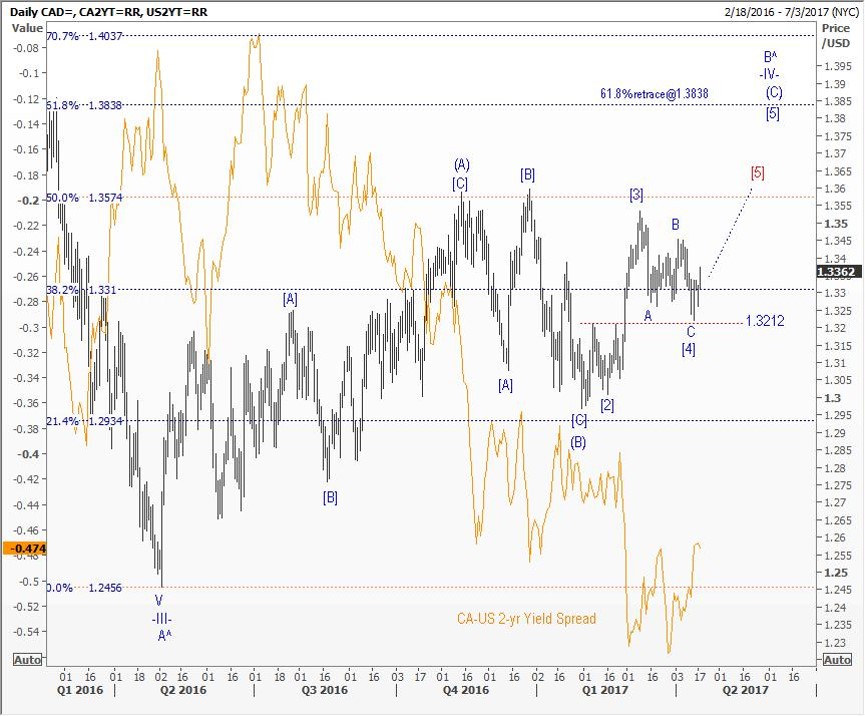

Canadian dollar (USD/CAD) vs. Canada-US 2-yr Yield Spread Daily: Looking for a move to the 1.3800-level (a 61.8% retrace of Wave A^ down)…

Oil vs. AUD/USD vs. CAD/USD Daily: The correlation with oil is tighter for CAD than it is for Aussie; but in general, the correlation between oil and Comdols has been steady over the last several years…

Read more…

Leave A Comment