Energy stocks are likely a Buy, just not Yet. The sector has potential, and for the best returns, investors will need to score the best entry. Our article today will be an update for our readers on energy stocks and price levels with potential to represent a possible entry.

Are Energy Stocks a Buy according to the price chart?

To answer this question, we will look into both Crude oil and XLE’s chart.

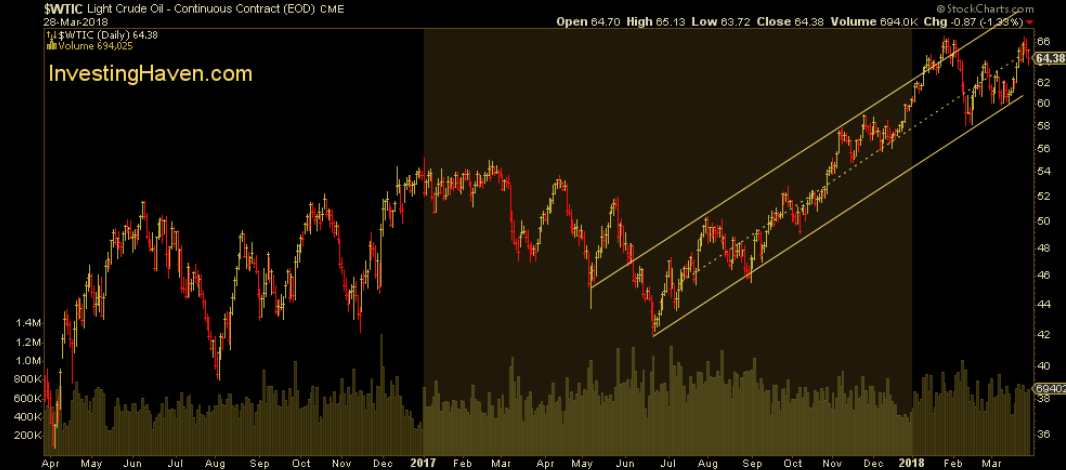

Crude Oil is currently in the resistance area towards the middle half of the ascending channel. If the price can break above that resistance and successfully backtest the support annotated with the dotted line, then Crude might head higher. Right now the crude might benefit from the weakness in the US dollar so investors will need to watch how the crude will clear or break below the resistance in the 65.50 area.

XLE, the Energy Select Sector SPDR ETF provides a good perspective on the performance of the actual energy stocks. When we wrote our Energy Stocks outlook for 2018 we mentioned the following:

The breakout in energy stocks will only take place once the 70 point level in XLE ETF is broken to the upside. Moreover, after a breakout, there is a high probability that prices come down to test the breakout point again, which, in the case of energy stocks, is 70 points in XLE.

XLE’s price broke the 70 USD to reach 77.50 USD. It also corrected to backtest the 70 points which didn’t hold. Since the 70 USD didn’t hold, we cannot confirm the breakout is successful,therefore, waiting for the confirmation might be the best course of action for investors especially considering the overhead resistance in the 72 area.

On the other hand, XLE made a higher high in its recent spike, 77.50 versus the previsous 75 USD and if 66 USD holds, that will make this a higher low compared to the dip from September 2017.

That’s why we believe that the energy sector stocks are a buy, just not right now. Investors want to see a confirmation first from the crude price and the XLE ETF.

Leave A Comment