In markets, we often hear of these precise levels, beyond which everything is said to unravel. The so-called “breaking point”.

Their allure is undeniable. If such a point existed, one could fully prepare for it in advance, exiting unscathed before the stampede of the masses.

Over the past few years, the most popular “breaking points” have been related to interest rates.

Starting with the first Federal Reserve hike in December 2015, which was said to be the “breaking point” for the economy/bull market, the predictions have been unrelenting. Hardly a day goes by now without some pundit throwing out a level on the 10-Year Yield (3%, 3.5%, 4%, etc.) or Fed Funds Rate (2%, 2.5%, 3%, etc.) that is said to be the level.

Do these “levels” have any basis in fact? Let’s take a look…

The 10-Year Treasury Yield is currently at 3.2%. After subtracting inflation of 2.3%, the real yield stands at 0.9%. Are such figures of any value in predicting equity market tops? Not exactly.

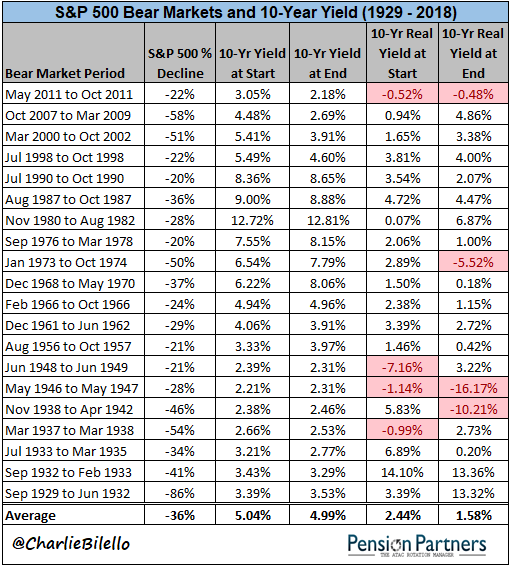

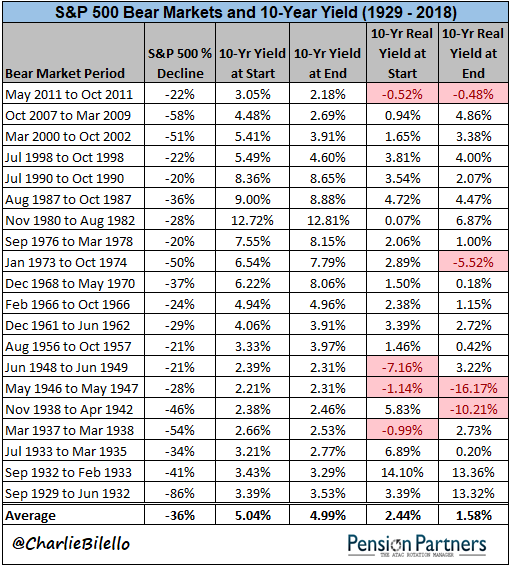

The table below illustrates the starting 10-Year Yield (nominal and real) at each of the Bear Markets in the S&P 500 going back to 1929. What you’ll notice is a total lack of uniformity from one Bear Market to the next. In 1946-47, stocks declined 28% from a starting 10-Year yield of just 2.21%, while in 1980-82 stocks declined 28% from a starting 10-Year Yield of 12.72%. Real yields show a similarly wide dispersion, with Bear Markets beginning with extremely low/negative real yields (1948-49) as well as extremely high real yields (1932-33).

The average 10-Year yield at the start of a Bear Market (5.04%) is not meaningfully different than the average in all periods going back to 1929 (4.97%). Neither is the average real 10-Year Yield (2.44% at the start of Bear Market vs. 1.86% in all periods).

Data Sources for all Charts/Tables Herein: Robert Shiller, FRED, Bloomberg.

What about the Fed Funds Rate?

Leave A Comment