Image source: Pixabay

Image source: Pixabay

In a highly anticipated speech at Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell signaled that the time has come for US interest rate cuts, pointing towards the end of the aggressive monetary policy in the US.Just a couple of weeks earlier, the financial markets were rattled with recession worries caused by a sudden rise in unemployment and the unwinding of the yen carry trade, prompting many analysts to increase their recession forecasts.This recent shift in the macroeconomic regime has provided a breathing room for the markets, but investors should be asking two important questions right now: Can we trust the Fed to get it right this time and are these rate cuts a bullish signal for the markets?

Can we trust the Fed to get it right?The Federal Reserve’s dual mandate—maximizing employment while ensuring stable prices—has guided its monetary policy decisions for over a century.However, the Fed’s track record in balancing these objectives has been far from perfect. History is littered with examples of well-intentioned policies that ended in economic disaster.During the Great Depression (1929-1933), the Fed’s aggressive tightening of monetary policy exacerbated the economic downturn, leading to a prolonged recession. Similarly, in the 1970s, the Fed’s attempt to combat high unemployment by keeping interest rates low for too long resulted in stagflation, an economic condition marked by high inflation and stagnant growth.More recently, in the run-up to the 2008 financial crisis, the Fed maintained low interest rates for an extended period, contributing to the housing bubble that eventually burst, triggering a global economic collapse.Given this history, the current environment presents its own challenges. The Fed must navigate a landscape of easing inflation but increasing employment risks.While Powell’s recent comments suggest a more cautious approach, the question remains: Will the Fed’s policy adjustments prevent a recession, or could they inadvertently trigger one?

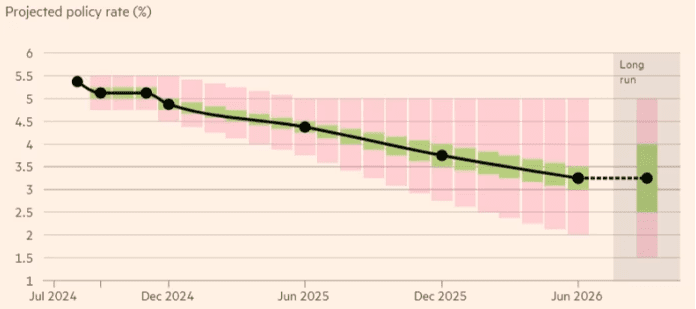

Tête-à-tête of current economic landscapeThe Federal Reserve has been signaling a shift in its monetary policy stance, with rate cuts likely on the horizon.At the July Federal Open Market Committee (FOMC) meeting, Powell strongly hinted that the Fed’s rate-cutting cycle could begin as early as September.This view has been reinforced by the minutes of the meeting and the more recent comments made at the Jackson Hole symposium.Inflation data has been encouraging, showing signs of moderation after stalling earlier in the year.However, the labor market has shown unexpected weakness, with July’s job market report triggering a significant market sell-off and raising recession fears.This has led some investors to bet on a more substantial 0.5 percentage point rate cut in September, although the consensus still leans towards a standard 0.25 percentage point reduction. Source: Bloomberg Looking ahead, the Federal Reserve is expected to commit to at least two rate cuts before the end of the year, starting with a 0.25 percentage point reduction in September, while another cut anticipated in December.In the meantime, some market participants expect more aggressive cuts, but the Fed is expected to proceed cautiously, reducing rates gradually as inflation eases and the labour market shows signs of weakening.Further rate cuts are expected in 2025, with the Fed potentially lowering rates four more times, aiming to bring the policy rate closer to the neutral rate of around 3.25%.

Source: Bloomberg Looking ahead, the Federal Reserve is expected to commit to at least two rate cuts before the end of the year, starting with a 0.25 percentage point reduction in September, while another cut anticipated in December.In the meantime, some market participants expect more aggressive cuts, but the Fed is expected to proceed cautiously, reducing rates gradually as inflation eases and the labour market shows signs of weakening.Further rate cuts are expected in 2025, with the Fed potentially lowering rates four more times, aiming to bring the policy rate closer to the neutral rate of around 3.25%.

Are rate cuts actually bullish?Rate cuts have often been viewed as bullish for financial markets, as lower borrowing costs can stimulate economic activity by encouraging investment and spending.However, the relationship between rate cuts and market performance is not always straightforward and largely depends on the context in which they occur.Historically, the market’s response to the first rate cut in a cycle has varied. For example, data from Dow Jones Market shows that the S&P 500 has typically gained an average of 2.5% three months after the first rate cut.However, this average hides significant variability. In 1995 and 1998, the S&P 500 rose by 12.7% and 22.3% respectively, one year after the Fed’s initial rate cut.Conversely, during the early 2000s and the 2007 financial crisis, the index dropped by 10.7% and 21.7%, respectively, one year after the Fed began cutting rates.This divergence in market performance underscores the role that underlying economic conditions play in forcing the Fed’s hand.When rate cuts are seen as a proactive measure by the Fed to sustain an already strong economy—such as during the mid-1990s—markets tend to respond positively.Investors anticipate that lower rates will boost corporate profits, encourage consumer spending, and push asset prices higher.However, when rate cuts are perceived as a response to significant economic distress, the reaction can be more subdued or even negative.Historical examples, like the early 2000s and the 2008 Financial Crisis, show that rate cuts driven by fears of a recession or financial instability can lead to market volatility and a sharp decline in investor confidence.In these cases, investors may interpret the cuts as a sign of deeper economic problems, which can undermine confidence and result in declining stock prices.

What lies ahead for investors?Given that markets are often forward-looking, the anticipated Fed rate cuts may not have the same impact as a surprise announcement.Investors have been expecting these cuts for months, so much of the potential upside may already be priced in. Currently, stocks are reflecting a “soft landing” scenario for the US economy, where traders expect the Fed to successfully lower borrowing costs without exacerbating labor market weakness. However, with valuations already at overheated levels—evidenced by the Shiller P/E ratio exceeding 36—any deviation from this soft landing narrative could lead to a significant market correction.Moreover, if negative economic data emerges in the coming months, the Fed could be pressured to implement a more substantial rate cut.While this might provide short-term relief, it could also send panic signals throughout the market, suggesting that the economic situation is more dire than previously thought. This combination of high valuations and potential economic weakness makes the Fed’s next move particularly risky, and a negative reception from the market seems increasingly likely.Given the Fed’s questionable track record in navigating past economic challenges, investors should apply their own critical thinking and look beyond the central bank’s statements, paying close attention to underlying economic signals before making any important investment decisions.More By This Author:NVDA Stock Falls 3% Even As Nvidia Reports 122% Revenue Increase GameStop Earnings Report: Is A Bull Run Possible For GME? Australia Limits International Student Enrolments To 270,000 In 2025 Amid Housing Concerns

Leave A Comment