The biggest question investors focused on earnings are trying to answer is how the gap between small cap and large cap firms’ margins will be closed. Either large cap firms will have their margins fall off the peak or small cap firms will see their margins rise to the 2013 peak. It’s possible that the gap can stay large, but the trend in small cap margins has been down which is an unsuitable divergence. Eventually that will impact larger firms because when the small ones begin to lay-off workers that will hurt the consumer. Layoffs from smaller firms also increases the slack in the labor force which can allow larger firms to give their employees smaller raises. While that’s a possibility, the economy would erode which would hurt more than the dampening wage inflation helps. Recessions still have large impacts on profits even though wage inflation is lowered. At the least, if you’re bullish on the earnings growth, you must expect small cap margins to stabilize.

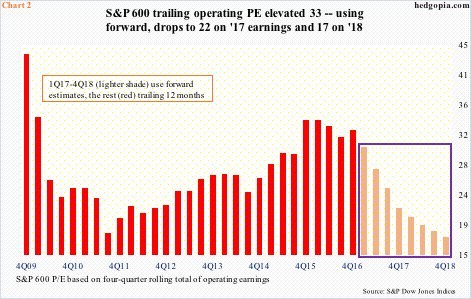

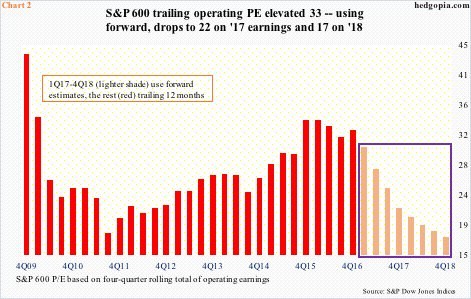

The consensus clearly believes small cap margins will rebound. As you can see from the chart below, the S&P 600’s trailing operating PE is at 33. Remember, operating earnings excludes taxes and interest, so the real price to earnings multiple is higher. When you move out to the future the price to earnings multiple drops to 22 using 2017 forward earnings and falls to 17 using 2018 earnings estimates. This price to earnings multiple falls to around the same level it was at in 2011 which is when earnings started to rise following the recession, but stocks hadn’t caught up with the improvements. That was a great time to buy stocks.

This brings the difference in opinions to the forefront. Even though trailing earnings are high, bulls believe now could be one of the best times to ever hold stocks. The high earnings estimates check the bear thesis that stocks are expensive. It’s true that estimates are usually cut before the reporting period, but the bulls will point to the current quarter’s growth rate as a signal that the negative earnings drift has ended.

Leave A Comment