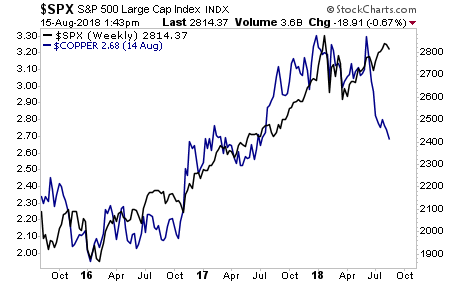

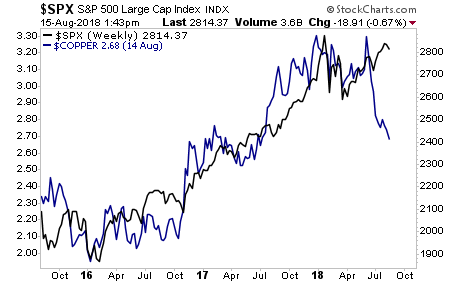

While there are no guarantees in the markets… sometimes you get a significant “tell” from related assets.

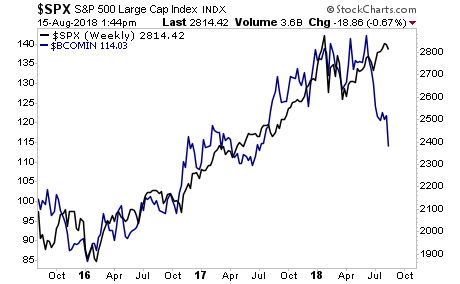

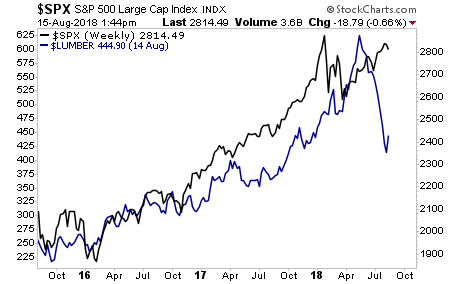

With that in mind, let’s take a look at some charts comparing various economic growth asset classes vs. the S&P 500.

Take a look at Copper vs. the S&P 500:

Here are industrial metals vs. the S&P 500.

Here’s Lumber (another “growth” sensitive commodity) vs. the S&P 500.

Looking at these three charts, it would appear stocks are due for a “wake up call”. Food for thought on this Friday.

Leave A Comment