Photo Credit: Mike Mozart

Urban Outfitters, Inc. (URBN) Consumer Discretionary – Specialty Retail | Reports May 18, After Market Closes

Retailers are in the spotlight this week and so far many of those names are getting slammed. Teen retailers, in particular, have made their comeback of late, but this may be the quarter reverses. Tomorrow, two teen standouts, American Eagle and Urban Outfitters, take the stage with their first quarter results. The past year has been quite difficult for Urban Outfitters’ shareholders. Relatively flat earnings and weak guidance sent the stock plunging 34% over the last 12 months. Unfortunately first quarter earnings should be more of the same.

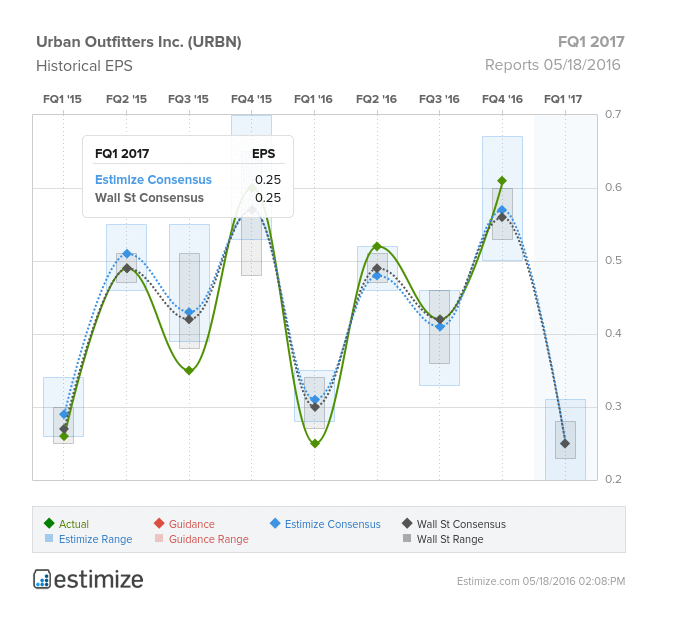

The Estimize consensus is calling for earnings per share of a quarter on $761.49 million in revenue, right in line with Wall Street on both the top and bottom line. Per share estimates have come down 7% in the past 3 months and now reflect flat growth. Revenue on the other hand is expected to grow by a meager 3%. Fortunately for investors, the stock is a positive mover during earnings season and historically increases 2% in the month following results.

Urban Outfitters is best known for operating leading lifestyle speciality retailers including its core Urban Outfitters brand, Anthropologie and Free People. Urban Outfitters remains focused on expanding its ecommerce sales while also improving comparable store sales performance. The company believes sustained investment in its direct to consumer business, enhanced productivity and inventory levels and adding new brands will help reach its goals.

Last quarter saw overall comparable store sales decline 2% as Urban Outfitters and Anthropologie struggled to stimulate growth. Free People was the lone bright spot and turned a 2% increase in net sales. A large portion of these challenges can be blamed on weak consumer spending habits in accessories and apparel and currency headwinds. Urban Outfitter’s presence in Canada and Europe continues to put pressure on margins and profitability.

Leave A Comment