Without Googling, try to guess who said the following quote: “If everybody indexed, the only word you could use is chaos, catastrophe. The markets would fail.”

Give up?

The speaker, believe it or not, is John Bogle, founder of Vanguard, which has been at the forefront of indexing. Bogle made the comment last year at the Berkshire Hathaway shareholder meeting, basically admitting that there’s a limit to the amount of passive investing the market can handle and still function efficiently.

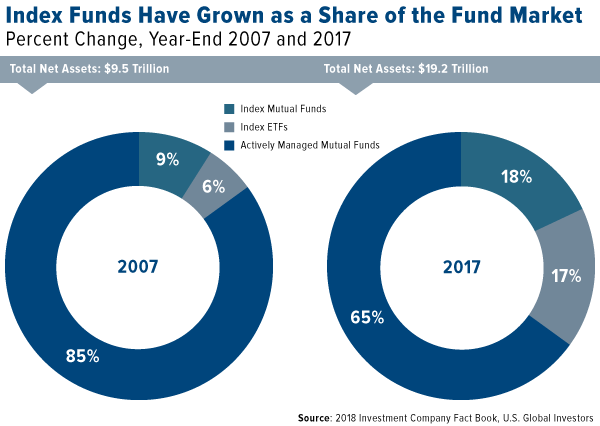

The thing is, we’re testing that limit more and more every day as passive mutual funds and ETFs—those that seek not to “beat the market” but track an index—take up a larger slice of the pie. The share has increased dramatically in the past 10 years, rising from only 15 percent in 2007 to as much as 35 percent by the end of 2017.

As for when passive investments will overtake the active market, Moody’s Investors Service estimates we’ll see this happen sometime between 2021 and 2024. Markets simply wouldn’t be able to function without active managers calling the shots—rewarding good corporate governance and punishing the bad—so Bogle’s what-if scenario of 100 percent indexing is, for now, purely hypothetical.

Nevertheless, the seismic shift into indexing has come with some unexpected consequences, including price distortion. New research, which I’ll get into below, shows that it has inflated share prices for a number of popular stocks. A lot of trading now is based not on fundamentals but on low fees. These ramifications have only intensified as active managers have increasingly been pushed to the side.

Watch Out for Rebalance Risk

This could end very badly for some investors, as I told CNBC Asia last week. It’s possible we could see a correction when it comes time for a number of multibillion-dollar funds to rebalance at year’s end. The same thing happened to the tech bubble in 2000, when everyone rebalanced after a phenomenal run-up in tech stocks.

Leave A Comment