I’m not going to “pull an Ed Lazear” and declare “no”. But the current versions of indicators are not very supportive of a “yes” answer.

Reader BC writes:

The US is likely in recession, which was not (and will not be) preceded by a yield curve inversion.

As noted in yesterday’s post, no US recession is indicated by current spreads. Key indicators [1] monitored by the NBER’s Business Cycle Dating Committee (BCDC) do not suggest we are in a recession currently, save industrial production.

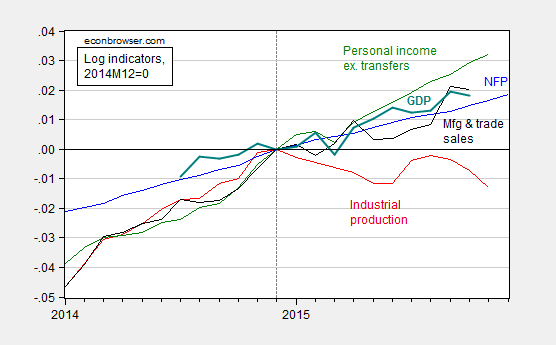

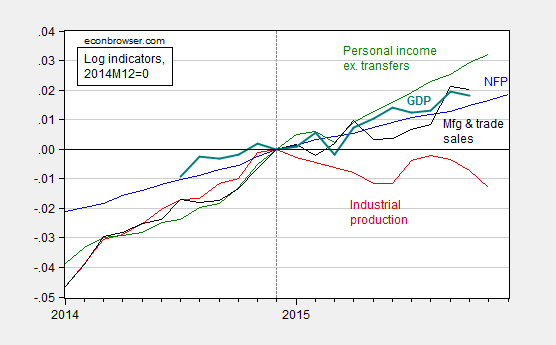

Figure 1: Log nonfarm payroll employment (blue), industrial production (red), personal income ex.-transfers in Ch.09$ (green), manufacturing and trade sales in Ch.09$ (black), and GDP in Ch.09$ (bold teal), all normalized to 2014M12 = 0. Source: BLS, Federal Reserve Board, St. Louis Fed, and BEA via FRED, Macroeconomic Advisers December 15th release, and author’s calculations.

Industrial production is 1.3% below peak. Interestingly, manufacturing output is 1% above peak. The other indicators continue to trend upward. Notice the monthly GDP measure is an estimate provided by Macroeconomic Advisers. Figure 2 depicts another measure of monthly GDP, as well as the official BEA measure.

Figure 2: GDP from BEA (blue bars), and from e-forecasting on 1/8 (red), and from Macroeconomic Advisers on 12/15 (green), all in bn. Ch.2009$ SAAR. Log scale. Source: BEA 2015Q3 3rd release, e-forecasting, Macroeconomic Advisers, and author’s calculations.

The 2010 BCDC memo lists Stock and Watson monthly GDP and GDI measures, as well as civilian employment and aggregate hours. Only the latter two series are freely available, so I’ll also plot those.

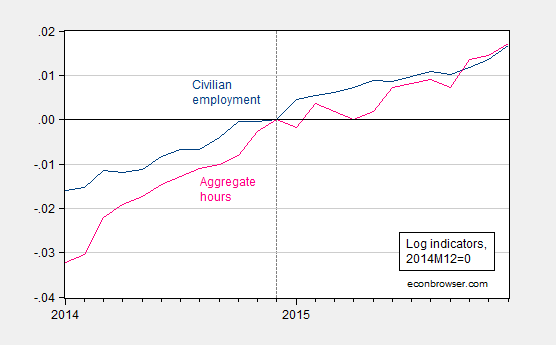

Figure 3: Log civilian employment (dark blue), and aggregate weekly hours in the private sector (pink), all normalized to 2014M12 = 0. Source: BLS via FRED, and author’s calculations.

Leave A Comment