On Friday, both the Bank of England AND the US Federal Reserve made clear signals that they WANT inflation.

The Bank of England is prepared to tolerate higher inflation over the next few years and will keep interest rates low to support economic growth, according to Governor Mark Carney.

Source: Telegraph

In a further indication that the Federal Reserve will be inclined to let inflation run hot for a while, Chair Janet Yellen on Friday said it’s useful to consider the benefits of a “high-pressure economy.”

Source: CNBC

These two announcements hit the same day at roughly the same time. This was a coordinated verbal intervention by two major Central Bank heads.

Folks, this is as close as you can possibly get to a Central Banker literally telling you what to buy. Central Banks want inflation and have even signaled that they’re willing to let it run ABOVE their targets.

Let’s be clear… once inflation hits, it is almost impossible to control. It’s not as though the Fed can let the inflation genie out of the bottle and solve the issue in a month or two.

Inflation ALWAYS spirals out of control first.

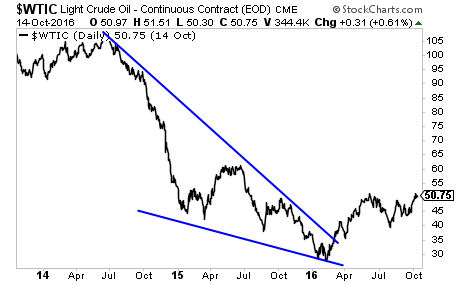

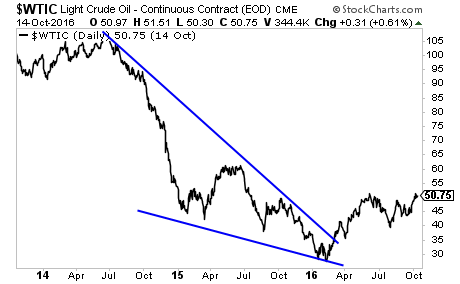

Take a look at oil. The downtrend from the 2014 top has been broken.

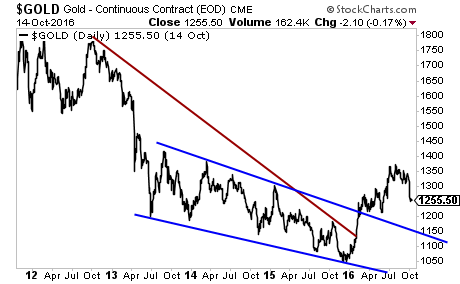

Gold has also figured it out with a major multi-year breakout.

BIG inflation is coming. Less than 99% of investors have figured this out. Those who do will make absolute fortunes with the right investment strategies.

Leave A Comment