Well, your time has come! Gold is in the process of testing the February breakout at a very important moving average. Whenever the market tests a breakout, it affords those who missed the breakout an opportunity to get onboard, and it enables those who helped to create the breakout, an opportunity to double up.

Charts are courtesy Stockcharts.com unless indicated.

Featured is the weekly gold chart.The purple arrow points to the spot where the gold price broke down below the 90 week EMA in early 2013. This breakdown led to three years of lower prices. The green arrow points to the spot where gold broke out to the upside in February.During the past four weeks price has been pulling back from a temporarily overbought condition, back towards the breakout point. You will notice that at $1215 we are within ten dollars of this important moving average!

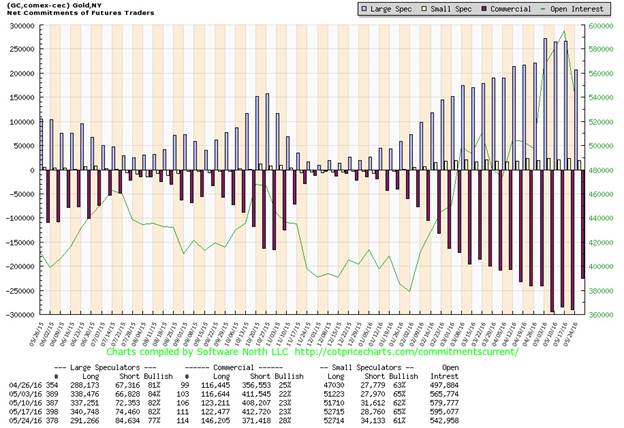

The rise in the price of gold since January 1st has been the most rapid in 30 years.Meanwhile commercial gold traders continue to hold a large ‘net short’ position. (Chart courtesy Cotpricecharts.com). The purple bars show a ‘net short’ (shorts minus longs) position of 225,000 contracts. Commercial traders usually sell into every rally, and then cap the rally by selling even more contracts, in order to depress the price and cover their short positions at a lower price.

When the price of gold was declining, as it was from 2011 to 2015, it was relatively easy for commercial traders to depress the price, by flooding the futures markets with offers to sell. This was blatantly obvious on April 21st 2013 when someone, or a group, dumped 16,000 gold contracts worth 2 billion dollars, along with 7,500 Charts contracts early in the morning and without attempting to get the best price for their product. Not being satisfied with the price, someone or a group on July 20th 2013 dumped 2.7 billion dollars worth of ‘paper gold’ in the space of 1 minute, just after midnight New York time. As amazing as it may seem, there are some who still deny that bullion banks and other commercial traders have manipulated the price of gold in the past.(Deutsche Bank recently admitted having taken part in price manipulations).

Leave A Comment