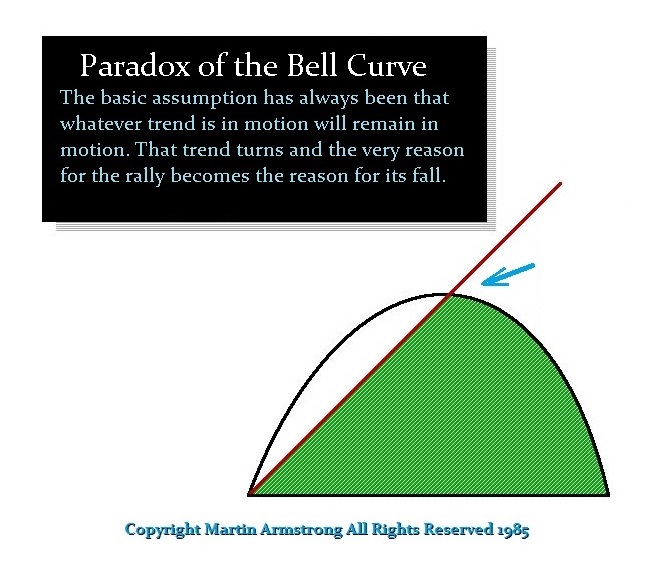

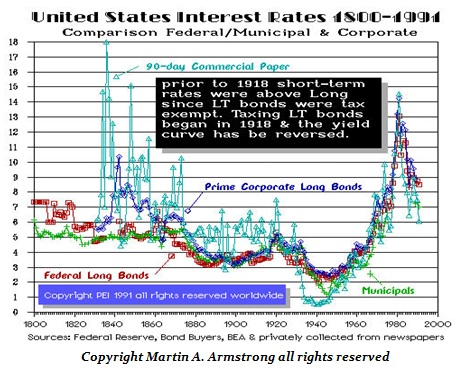

Argentina has just raised interest rates to 40% trying to support the currency. I have explained many times that interest rates follow a bell curve and by no means are they linear. This is one of the huge problems behind attempts by central banks to manipulate the economy by impacting demand-side economics. Raising interest rates to stem inflation will work only up to a point and even that is debatable. The entire interrelationship between markets and interest rates has three main phase transitions and each depends upon the interaction with confidence of the people in the survival of the state.

PHASE TWO:

Raising interest rates will flip the economy as Volcker did in 1981 only when they exceed the expectation of profits in asset inflation provided there is confidence that the government will survive as in the USA back in 1981 compared to Zimbabwe, Venezuela, Russia during 1917 or China back in 1949. In other words, if the nation is going into civil war, then tangible assets will collapse and the solution becomes assets flee the country.

In the case of the USA back in 1981, the high interest rates worked because we were only in Phase Two where there was no civil war or revolution so the survivability of the government did not come into question. Hence, Volcker created deflation as capital then ran away from assets and into bonds to capture the higher interest rates. Then and only then did rates begin to decline between 1981 into 1986 reflecting the high demand for US government bonds, which in turn drove the US dollar to record highs and the British pound to $1.03 in 1985 resulting in the Plaza Accord and the creation of the G5 (now G20).

So many people want to take issue with me over how the stock market will rise with higher interest rates. It is a bell curve and you better begin to understand this. If not, just hand over all your assets to the New York bankers now, go on welfare and just end your misery.

Leave A Comment