Argentina once again seeks help from the IMF following yesterday’s 40% interest rate hike.

Last year, Argentina was a favorite destination for investors. This year, Argentina is facing yet another currency crisis.

A run on the Peso started last month as investors soured on the country. To combat the run, the Argentine central bank hiked rates to 40%.

“The market has been in total panic mode the last few days,” said Brendan Murphy, head of global and multisector fixed income at BNY Mellon Asset Management North America.

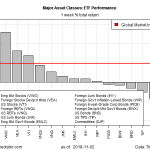

The declines are the latest sign that rising U.S. interest rates and a strengthening dollar are prompting investors to pull money out of some of the world’s riskiest markets, especially those with the largest trade and budget deficits.

Other higher-risk markets like Indonesia and Turkey also have suffered big declines in recent days. Standard & Poor’s Global Ratings on Tuesday cut Turkey’s sovereign-debt rating further into junk, citing the country’s debt, rising inflation and volatile currency. Turkey’s main stock market has fallen 4.7% last week, while its currency has declined 4.4%. Indonesia’s JSX Composite Index slumped 6.6% the week ending April 27—the most of any major index globally, according to FactSet—when foreigners fled the market.

Argentina Calls IMF

Once again, Argentina finds itself in a currency crisis. Reuters reports Argentina president says seeking financing from IMF.

“Just a few minutes ago I spoke with Director Christine Lagarde, and she confirmed we would start working on an agreement today,” Argentina’s President Mauricio Macri said in an address to the nation.

Honey, the IMF is Here

I know, I know – Stiglitz. Still…https://t.co/eMBaQBtPmV pic.twitter.com/jgyaLFzNje

— Rudolf E. Havenstein (@RudyHavenstein) May 8, 2018

Leave A Comment