Arista Networks (ANET) is down by almost 30% from its highs of the last year. This is mostly due to a broad market selloff particularly affecting growth stocks in the tech sector lately. Besides, there have been rumors about the possibility of Amazon (AMZN) increasing its presence in the networking sector.

However, the big picture is Arista Networks looks as strong as ever, and chances are that the recent pullback will turn out to be a buying opportunity for investors with a long-term horizon.

A High Growth Company

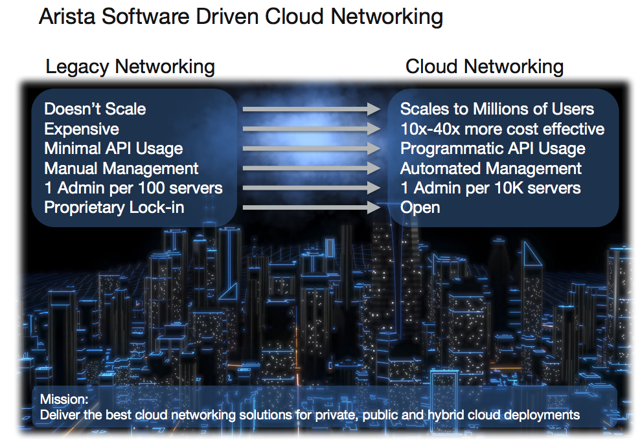

Arista Networks delivers software-driven cloud networking solutions for large datacenter and cloud computing companies. The company offers a wide variety of Gigabit Ethernet switches that significantly improve the price and performance equation of datacenter networks.

Source: Arista

According to management, the data center switching market is projected to grow to $13 billion in 2021, and Arista Networks is currently the number two player in terms of size and the fastest growing supplier of products to this market. The company has also entered the routing market with its R-Series platform, which could be an additional multi-billion dollar opportunity in the years ahead.

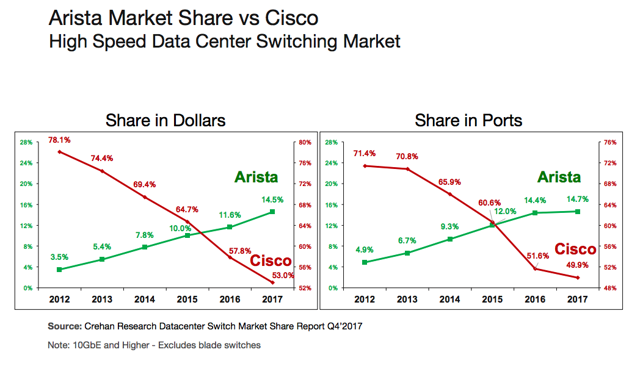

Arista Networks competes against bigger companies with deeper pockets such as Cisco (CSCO). But the company is outgrowing Cisco and stealing market share from its larger rival. This speaks volumes about Arista’s technological prowess and its ability to successfully compete against all kinds of players.

Source: Arista

There have been rumors about Amazon entering the networking space lately, and this is creating some uncertainty around Arista Networks’ stock. Amazon has denied those rumors, and it doesn’t really make a lot of sense for Amazon to enter this market. In any case, Arista Networks has proven its ability to compete and win versus larger rivals, so selling Arista because of unfounded rumors about Amazon entering the space is short-sighted at least.

Leave A Comment