Ever since oil prices fell from their Q2 2014 peak I have been predicting Dril-Quip’s DRQ demise. Offshore E&P has dried up and it will eventually hurt the company’s top line. The company generates 69% of its revenue from subsea equipment sales. Q4 revenue from that segment was flat sequentially after having fallen 13% in the previous quarter.

DRQ has not experienced the free fall I have been predicting. The stock is off about 13% over the past year versus a flat return for the S&P 500 SPY. Despite flat to declining revenue Dril-Quip’s EBITDA margins have held up well due to management’s cost containment efforts. Full-year 2015 revenue was off about 9% Y/Y. However, EBITDA only fell 2% as the company improved margins from 31% in 2014 to 33% in 2015. Otherwise DRQ might have fallen much further. Analysts expect deep water drilling to experience a severe downturn in 2016. Margins might also take a hit due to a loss of scale.

The Model Says $61 However …

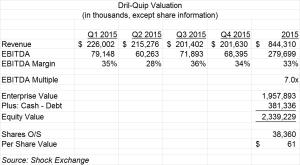

According my bottoms up analysis based on 2015 EBITDA, DRQ is worth $61.

2015 Revenue

2015 revenue is actual full-year revenue for the past year. Revenue fell sharply after Q1 but was flat in the second half of the year. Until actual results come in much lower, one could argue that last year’s revenue could be a decent starting point for a valuation.

EBITDA

EBITDA represents actual results for 2015. I expect the company to continue to cut costs in an attempt to maintain margins. Margin erosion could be the one event that causes investors to abandon the stock.

EBITDA Multiple

A multiple of 5.0x to 7.0x is appropriate for an industry leader in a cyclical industry in decline. I awarded Dril-Quip with a valuation at the top end of the range; its revenue and EBITDA have been relatively stable considering the free fall in oil prices and oil & gas capex.

Enterprise Value

The company’s enterprise value (equity and debt) would be $2.0 billion.

Equity Value

Leave A Comment