Zero Hedge readers might have noted our increasingly bearish tone on all things Australian – economic that is, since the cricket team just whipped the English in the first test match in Brisbane. The focal point of our concern is the housing market and, earlier this month, we discussed how the world’s longest-running bull market – 55 years – in Australian house prices appears to have come to an end. We followed this up with “Why Australia’s Economy Is A House Of Cards” in which Matt Barrie and Craig Tindale described how Australia’s three decades long economic expansion had mostly been the result of “dumb luck”.

As a whole, the Australian economy has grown through a property bubble inflating on top of a mining bubble, built on top of a commodities bubble, driven by a China bubble.

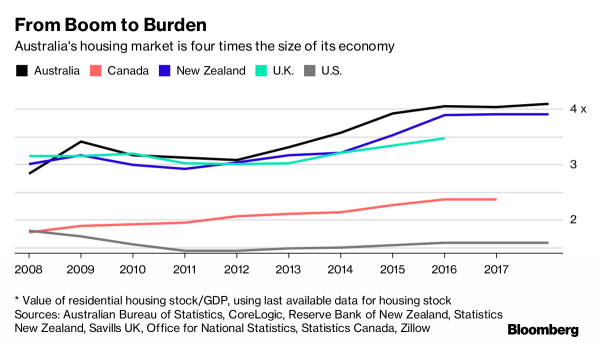

Last week, in “The Party’s Over For Australia’s $5.6 Trillion Housing Market Frenzy”, we highlighted some scary metrics for Australia’s housing bubble cited by Bloomberg. In particular, we showed how the value of Australian housing is more than four times gross domestic product. This is higher than other western nations, like New Zealand, Canada and the UK, which are experiencing their own housing bubbles. The ratio of house values to GDP in the US seems positively tame in comparison.

It seems that it’s nor just us and other market commentators who are becoming progressively more pessimistic on Australia’s outlook. Australians are coming round to the same opinion, as Australia’s Domain.com explains (note: Roy Morgan is an Australian market research company).

The number of Australians optimistic about the year ahead has dropped to a never-before-seen low as mortgage holders eye a combination of record-high household debt and the possibility of interest rate hikes in 2018.

According to a Roy Morgan survey taken in mid-November, 31 per cent of people think 2018 will be “better” than 2017 – the lowest figure recorded since the survey began in 1980.

Leave A Comment