I know all the cool kids like to quote Nassim Taleb and give dire warnings about the coming collapse of risk assets, but I must have too many years of playing Dungeons & Dragons because I just can’t seem to join their club. I don’t see the same black swans that everyone else does. Central Banks have gone giant-golden-crowned-flying-fox batshit crazy, and instead of looking at the possibility that this unprecedented science experiment explodes in a fiery inflationary explosion to the upside, the “in-crowd” are all convinced the collapse has to look exactly like 2008 (only worse).

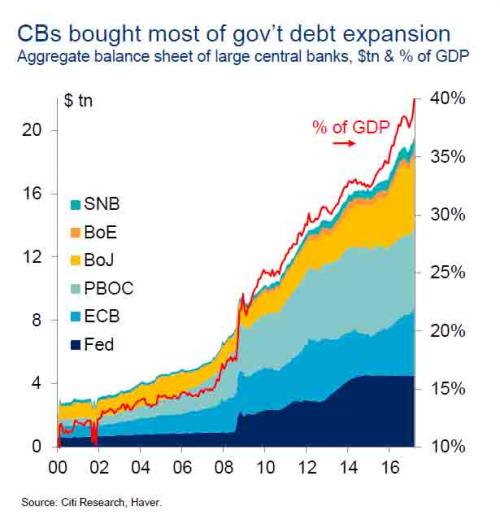

And yeah, there is no doubt that given the stretched valuations in risk assets, a Central Bank tightening error might have catastrophic consequences. Yet, I believe there is at least an equal chance that Central Bankers have made (or will make) a colossal overshoot error. You are probably getting bored with my posting of the chart of Central Bank balance sheets, but I am amazed at how these Central Bankers can write billions of dollars of blue tickets, and we don’t bat an eye.

The Swiss National Bank owns $85 billion of US equities. F’ me. That’s just absurd.

Central Banks are printing money out of thin air and buying stocks with it. Stop a moment and really take that in. Short term interest rates are negative in many parts of the developed world. Negative! How do you price equities with negative interest rates and Central Banks competing with blue tickets?

But hey! What do I know? Maybe all this extreme monetary stimulus means that when the business cycle finally kicks in, the fall will be all the more violent. That’s certainly the prevalent thinking amongst the “cool kids.”

And while a good portion of this crowd is busy buying VIX and shorting stocks, the more sophisticated are buying protection on corporate bonds. This trade has much less negative carry and presents a much better asymmetrical risk reward profile. Corporate bonds can, at best, only return the interest, but can lose the whole principal.

Leave A Comment