The 2017 edition of the Jackson Hole symposium is officially over, and while central bankers disappointed markets by not providing any insight into their views on monetary policy (assuming they have any) they instead focused on market stability, and patted themselves on the back for creating a fake “risk-free environment” (which they justify by the record low VIX, even if ignoring the record high cost of crash insurance).

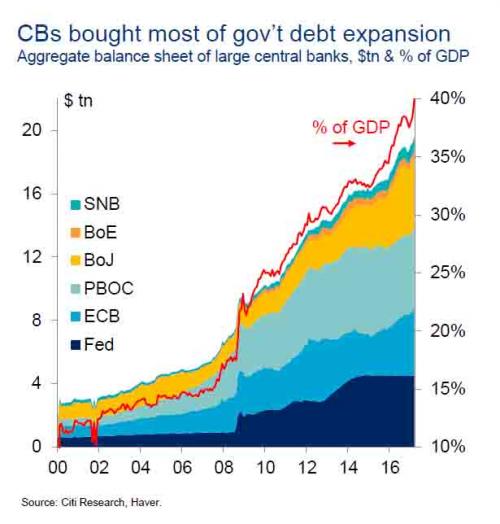

In an amusing twist, Janet Yellen’s speech started off by highlighting that one of the key features of the $14 trillion in post-crisis central bank asset purchases, which has resulted in central banks purchases accounting for 40% of global GDP, is pervasive risk amnesia:

A decade has passed since the beginnings of a global financial crisis that resulted in the most severe financial panic and largest contraction in economic activity in the United States since the Great Depression. Already, for some, memories of this experience may be fading–memories of just how costly the financial crisis was and of why certain steps were taken in response.

Here, one could almost accuse the Fed of hypocrisy for doing everything in its power to “fade” the memories of the 2008 financial crash with trillions in asset purchases, and on the other to lament the short memories of market participants who get steamrolled by a new and improved QE (or jawboning threats thereof as per James Bullard) every time the market takes an even modest dip.

What is just as amusing is that for the first time, a seemingly “bipolar” Yellen – and thus the Fed – pervasive risk amnesia:

The U.S. and global financial system was in a dangerous place 10 years ago. U.S. house prices had peaked in 2006, and strains in the subprime mortgage market grew acute over the first half of 2007. By August, liquidity in money markets had deteriorated enough to require the Federal Reserve to take steps to support it. And yet the discussion here at Jackson Hole in August 2007, with a few notable exceptions, was fairly optimistic about the possible economic fallout from the stresses apparent in the financial system.

Leave A Comment