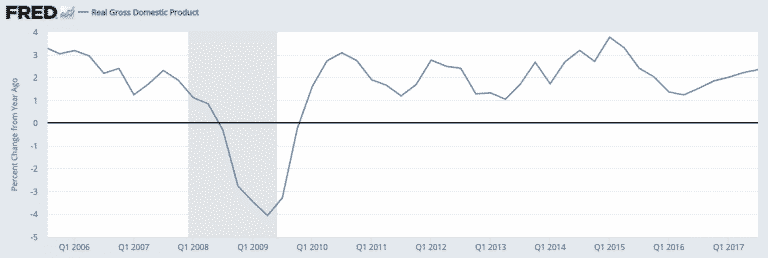

I started writing this post last Thursday before the US jobs report came out and the point I was going to make initially was that I expected good things from that report on the heels of some pretty robust jobless claims reports and 190,000 private sector jobs in the ADP report. Moreover, while we can’t expect 3% growth in the US to last indefinitely, there are no signs of weakness in the real economy in the US – or in Europe or Japan for that matter. Given where we are right now, I think this expansion will continue through the end of 2018. And so, I want to talk about what that means in the context of my last post and recent BIS warnings on financial markets.

The macro backdrop is good

First, on the real economy, recessions don’t come out of nowhere. Generally, economic vulnerability has to be present – a ‘stall speed’ economy vulnerable to an economic shock. And then you need that shock to occur and have enough bite to push the economy into recession.

For example, the last big shock the US economy took was the drop in oil prices from over $100 in mid-2014 to $30 a barrel at the beginning of 2016. We saw a virtual halt in shale oil capital expenditure that had a measurable impact on GDP growth starting in early 2015 when prices had already fallen into the $50-60 range.

That’s when Continental Resources announced a cut to capex down to $920 million from $2.7 billion in 2015. And even the majors were cutting capital expenditure so much that as the year began analysts at Bernstein Energy were expecting a 38% sector-wide cut to capex in 2016. But this was the bottom for oil prices. And while we hit a low of 1.2% growth, year-over-year numbers never went into recession territory.

We would have needed another major economic shock – like an aggressive interest rate hike campaign – once we hit 1.2% to send the economy into recession. And if you recall, the Fed had been saying it was going to hike multiple times in 2015 and 2016. But the Fed slow-walked its tightening as the poor data came in, and eventually, the economy recovered.

By contrast, in the decade before, the slowdown in the housing sector eventually proved too large to overcome and we had a financial crisis and recession. But even there, there was a big lag. House prices in the US actually peaked in 2005 and recession didn’t arrive until December 2007. So we had over two years of deceleration in the housing sector before the economy finally turned down. And I think this is important when thinking about where we go from here in this cycle.

Leave A Comment