After President Trump unveiled his tax plans, many had predicted that the US dollar would strengthen thanks to the inflationary impact of reducing taxes by $1.5T. According to academic theory, an economy with limited slack and high growth is at the risk of overheating if fiscal stimulus is excessive. This is especially true as crude oil (a significant driver of inflation), continues to make multi-year highs. Given recent weakness in the US dollar, markets clearly did not follow academic theory.

As the global reserve currency, the US dollar tends to depreciate during booms

The main reason the US dollar remains weak is due to the currency’s status as the world’s global reserve currency. In short, the world runs on US dollars. During economic booms, US dollars are cheaply and widely available via offshore lending markets (i.e. the Eurodollar market). As borrowed dollars flood the world, the price of financial assets (including other currencies) tends to appreciate accordingly. We are seeing this today with the euro in particular. As we wrote yesterday, EUR/USD has room to keep climbing thanks to strong Eurozone growth.

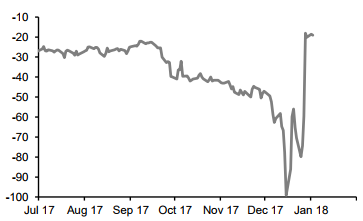

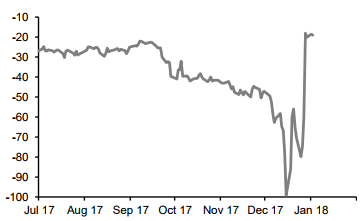

Thanks to the ongoing boom, US dollar liquidity remains abundant. Our favorite USD liquidity indicator, gold, has been strengthening throughout 2017 and especially since mid-December. Eurodollar lending rates have also fallen sharply after spiking in late December. The rise and fall of Eurodollar rates (as measured by cross-currency basis points) is shown below. Note that negative rates in the chart below imply higher interest rates on borrowed dollars.

Nothing to see here: 3-month euro cross-currency basis

Source: CommerzBank

In a previous commentary, we showed that the Eurodollar market is larger than ever, despite its central role in causing the last global financial crisis. According to the Bank for International Settlements, US dollar liabilities for non-US banks are above crisis-era highs at $9T. As long as the good times continue, borrowed dollars will keep flowing and the currency will keep selling off.

Leave A Comment