Despite weak Chinese data earlier this week that had analysts questioning economic stability in the region, Asian stocks soaring today, Wednesday, with both Chinese and Japanese stocks rising and the Topix index advancing in all 33 sectors. Japan’s Nikkei 225 led the pack with 5.8 percent gains during trading on Wednesday up to 18,436.14 at once point, and reversing Tuesday’s dramatic losses, while the Topix index gained 5 percent, with financial shares accounting for the broadest gains.

Despite today’s rally analysts are questioning whether slower growth in China will delay the Fed’s planned rate hike, which was originally thought to occur in June, and then this month. Many who were originally certain that the rate hike would occur are now expecting restraint until the global economy shows more signs of stability. Similarly, a Bank of America study concluded that the Fed rarely stirs the waters when the equity markets are exhibiting signs of turbulence, and with the S&P 500 down 5.3 percent over the last three months, there’s no question that the markets are not exhibiting the signs of strength typically associated with a rate hike.

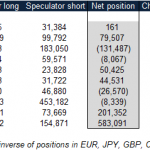

Reduced expectations for a rate hike this month caused the U.S. dollar to trade slightly lower against global currencies during Tuesday’s session. On Wednesday the Job Openings and Labor Turnover Survey will be reported and on Friday producer price index and consumer sentiment will be out, and analysts are watching these reports closely in advance of the Fed’s announcement next week.

Leave A Comment