The Australian dollar had a rough time to rise despite strong inflation numbers. The pound also struggles to rise. Here is the view from SocGen:

Here is their view, courtesy of eFXnews:

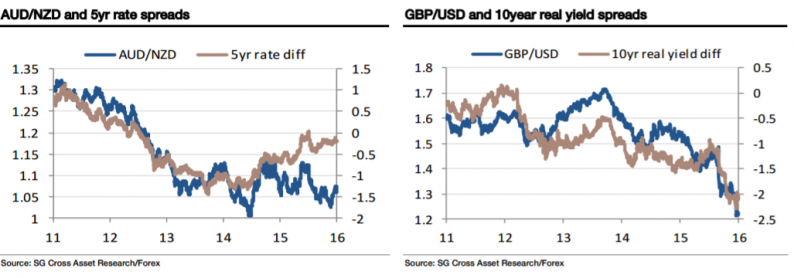

The Australian Q3 headline inflation picked up to 1.3% from 1%, more than expected, which dented market expectations of an RBA rate cut. The RBA’s favoured measure, the trimmed mean CPI, is steady at 1.7% and the data don’t seem to us to rule out a further cut in due course, but AUD has rallied. Our bias with the AUD is still only to buy it against the New Zealand dollar, where rate differentials are pretty compelling and the Kiwi still looks overvalued.

GBP/USD was trading at 1.2230 before falling into its latest air pocket yesterday, fuelled by very little more than chatter about whether Mark Carney would announce that he will not see out his full term at the Bank of England. In the event, his testimony to the House of Lords saw him push back a little against the idea that the MPC will simply look through a currency-induced pick-up in inflation. A three tick fall in 20178-dated short sterling futures isn’t a seismic shift, but GBP/USD, though it bounced, has only recovered a little over half the fall.

Down by the lift, back up by the stairs (and struggling). Sterling is vulnerable to a sharp spike slower even if relative rates and the scale of the economic hit suggest the bulk of the Brexit have been made.

Leave A Comment