Political pundits are commemorating Trump’s first 100 days in office. It has also been 100 days since AUD/USD traded at the current level of 0.7465.

This popular currency pair is below the 0.7470 level that was seen earlier in April. It last dipped to these levels on January 17th, just before Trump’s inauguration.

Why is the Australian dollar falling?

The latest reason for the slip in the value of the A$ stems from the quarterly inflation report. Quarter over quarter, prices advanced by 0.5%, slightly below 0.6% expected. Yet even a slight miss found fertile ground, as Australia stands out by publishing CPI only once per quarter.

In addition, the US dollar was already strengthening against commodity currencies. The Canadian dollar led the downfall on falling oil prices and what seems like a trade war with Canada on milk and timber.

The Australian dollar is not far behind. Prices of iron ore on the slide, and are forecast to drop even further. These estimates come despite stronger growth in China, the main consumer of metals that Australia exports.

AUD/USD levels to watch

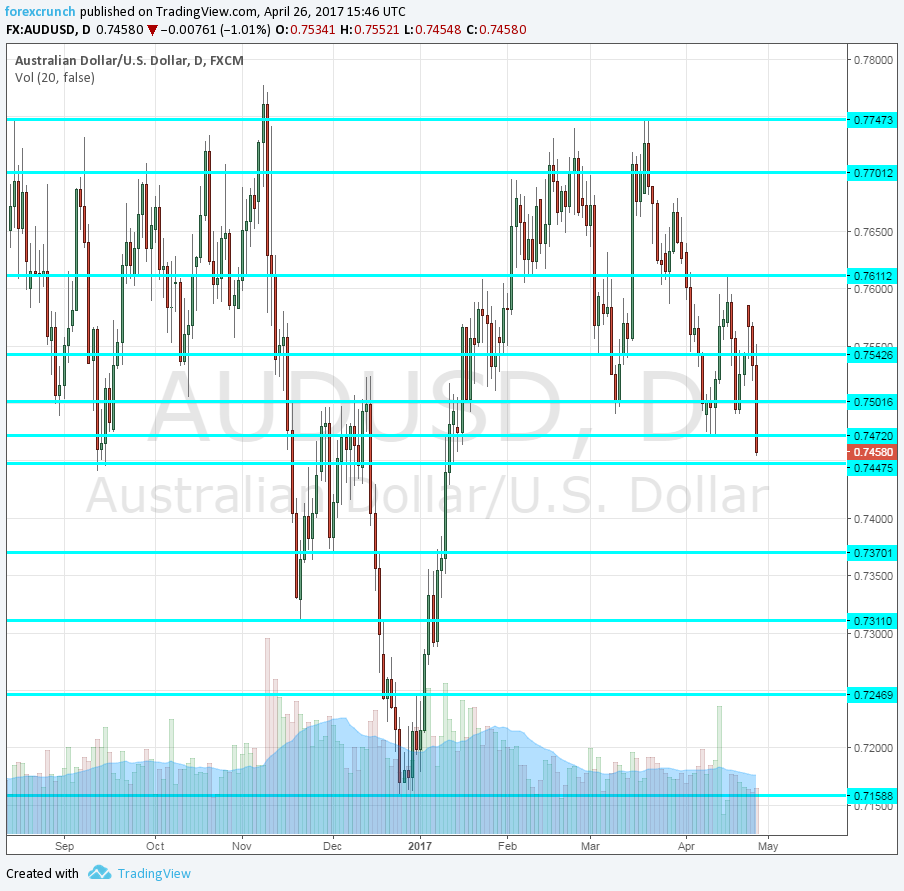

The next level of support is quite close, but it may not be that strong. 0.7445 was the low point seen back in September. From there, the Aussie jumped to higher ground.

The next level is more recent, from November: 0.7370. It was a bouncing spot for AUD on its way for a temporary rise.

Stronger support awaits at 0.7310, a trough in November. Even lower, we find 0.7245 as weak support, followed by 0.7160 at the very bottom of the cycle, just around the turn of the year.

On the topside, we are more familiar ground. Above 0.7470, the pair could be capped at the round level of 0.5. Higher above, 0.7540 works as another stepping stone. Tough resistance awaits at 0.7610. The latter served as support when the pair enjoyed a higher range of trading. It later rejected attempts for a recovery.

Leave A Comment