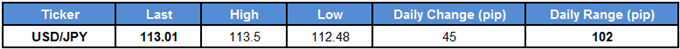

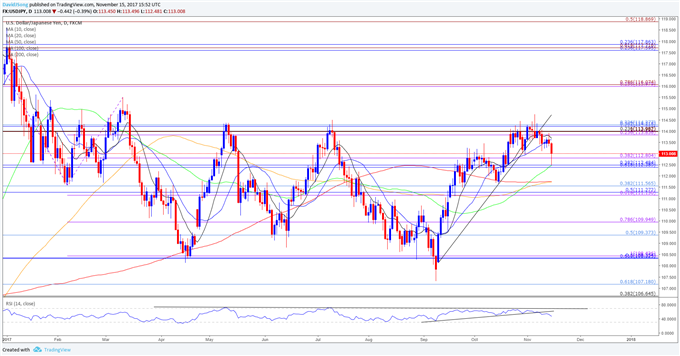

USD/JPY faces a growing risk of giving back the advance from the 2017-low (107.32) as it snaps the narrow range from earlier this week and it initiates a fresh series of lower highs & lows.

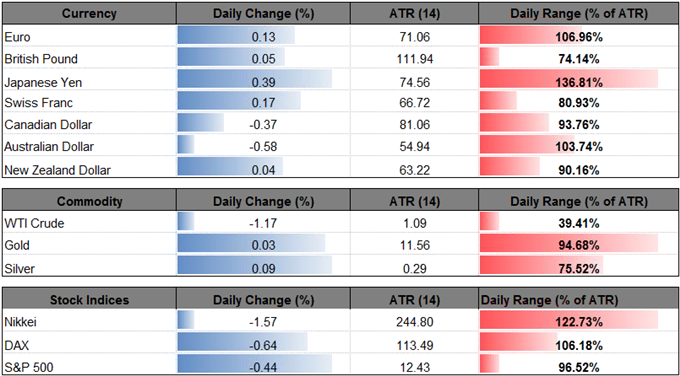

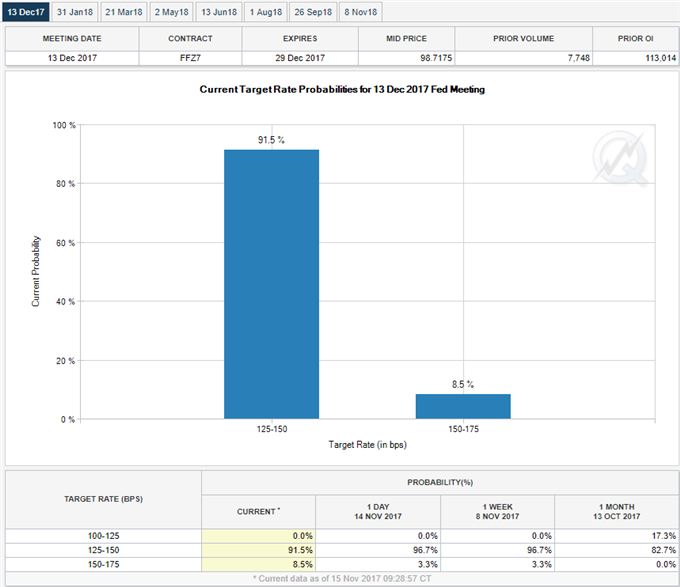

Despite the unexpected uptick in the core U.S. Consumer Price Index (CPI), the ongoing batch of mixed data prints may continue to dampen the appeal of the greenback as Fed officials strike a more cautious tone ahead of its last interest rate decision on December 13.

Following the fresh remarks from St. Louis Fed President James Bullard, Chicago Fed President Charles Evans, a 2017 voting-member on the Federal Open Market Committee (FOMC), also struck a cautious tone and warned ‘something more persistent is holding down inflation’ as price growth continues to run below the 2% target. In turn, a growing number of Fed officials may forecast a more shallow path for the benchmark interest rate as the U.S. economy appears to be facing ‘facing below-target inflation expectations.’

Even though the FOMC is still expected to deliver another rate-hike in December, the dollar-yen exchange rate may continue to consolidate over the remainder of the year as the central bank runs the risk of concluding its hiking-cycle ahead of schedule.

USD/JPY Daily Chart

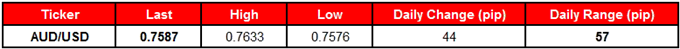

AUD/USD carves a bearish series after clearing the October-low (0.7625), but another 18.8K expansion in Australia Employment may temper the recent decline in the exchange rate as it instills an improved outlook for growth and inflation.

Leave A Comment