Yesterday, the Australian dollar increased sharply against the greenback, which resulted in a breakout above the upper border of the consolidation. How high could the exchange rate go in the coming days?

EUR/USD

Yesterday, we wrote the following:

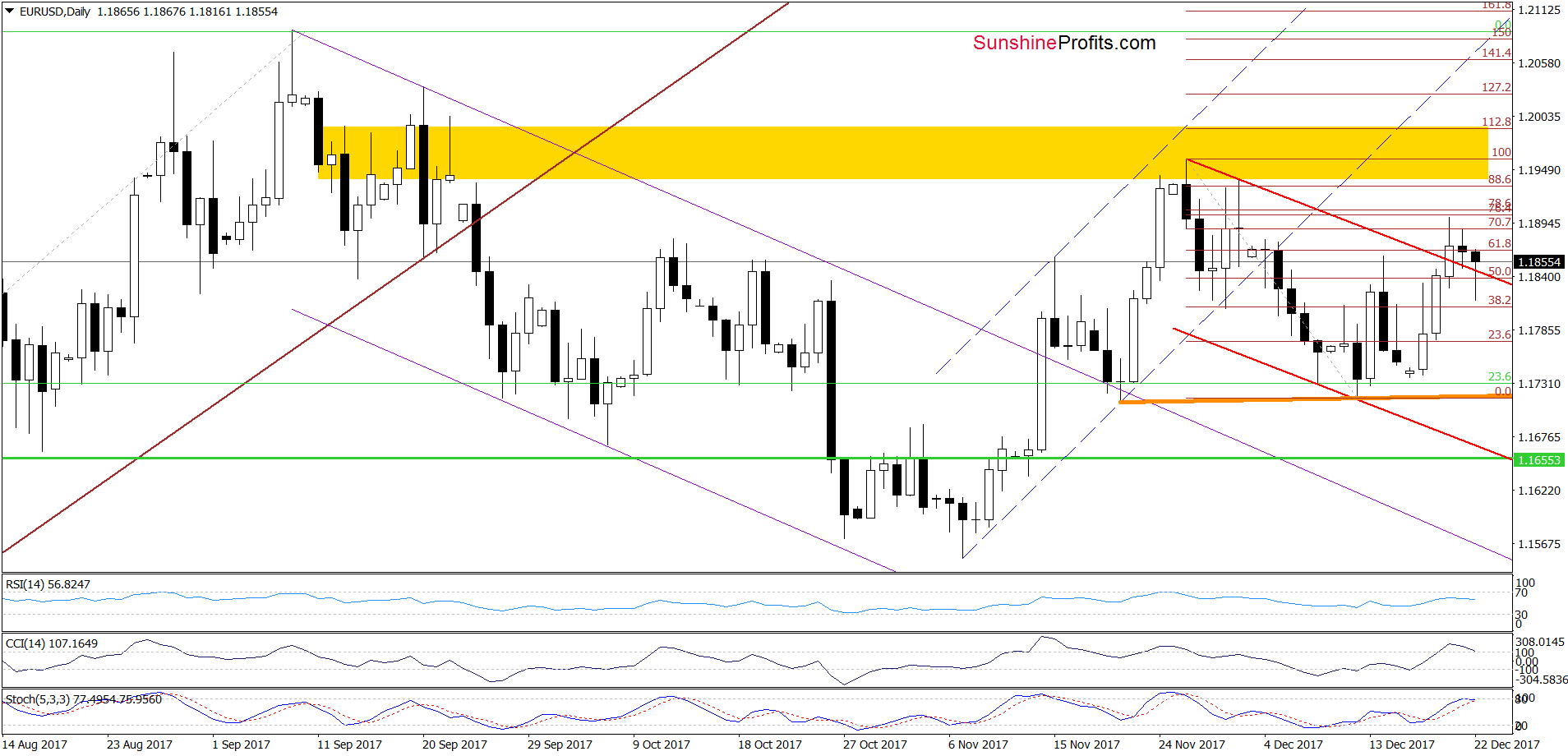

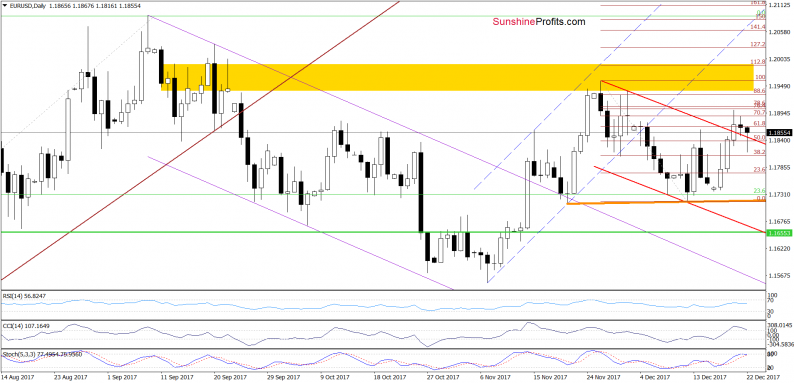

(…) the combination of the 76.4% and 78.6% Fibonacci retracements (based on the entire recent downward move) stopped currency bulls, triggering a pullback. Earlier today, the exchange rate wavers between this resistance area and the previously-broken upper line of the declining trend channel, but considering the current position of the daily indicators, we think that another move to the downside is just around the corner.

If this is the case we’ll see a test of the upper red line or even an attempt to invalidate yesterday’s breakout. This scenario is also reinforced by the broader picture of the pair.

From today’s point of view, we see that the situation developed in line with the above scenario and currency bears pushed EUR/USD under the upper border of the red declining trend channel earlier today. Despite this move, their opponents triggered a rebound, which invalidated the breakdown in the following hours.

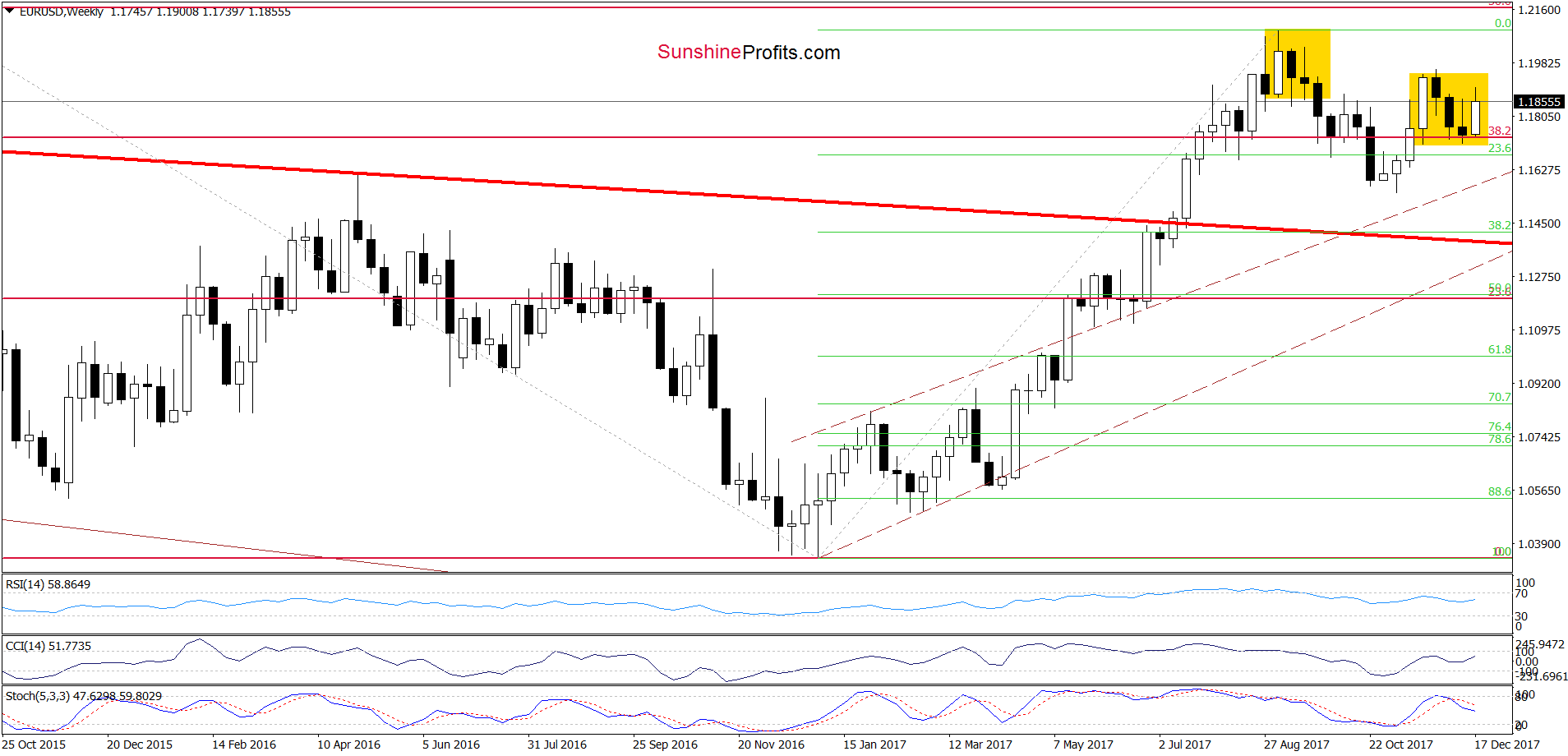

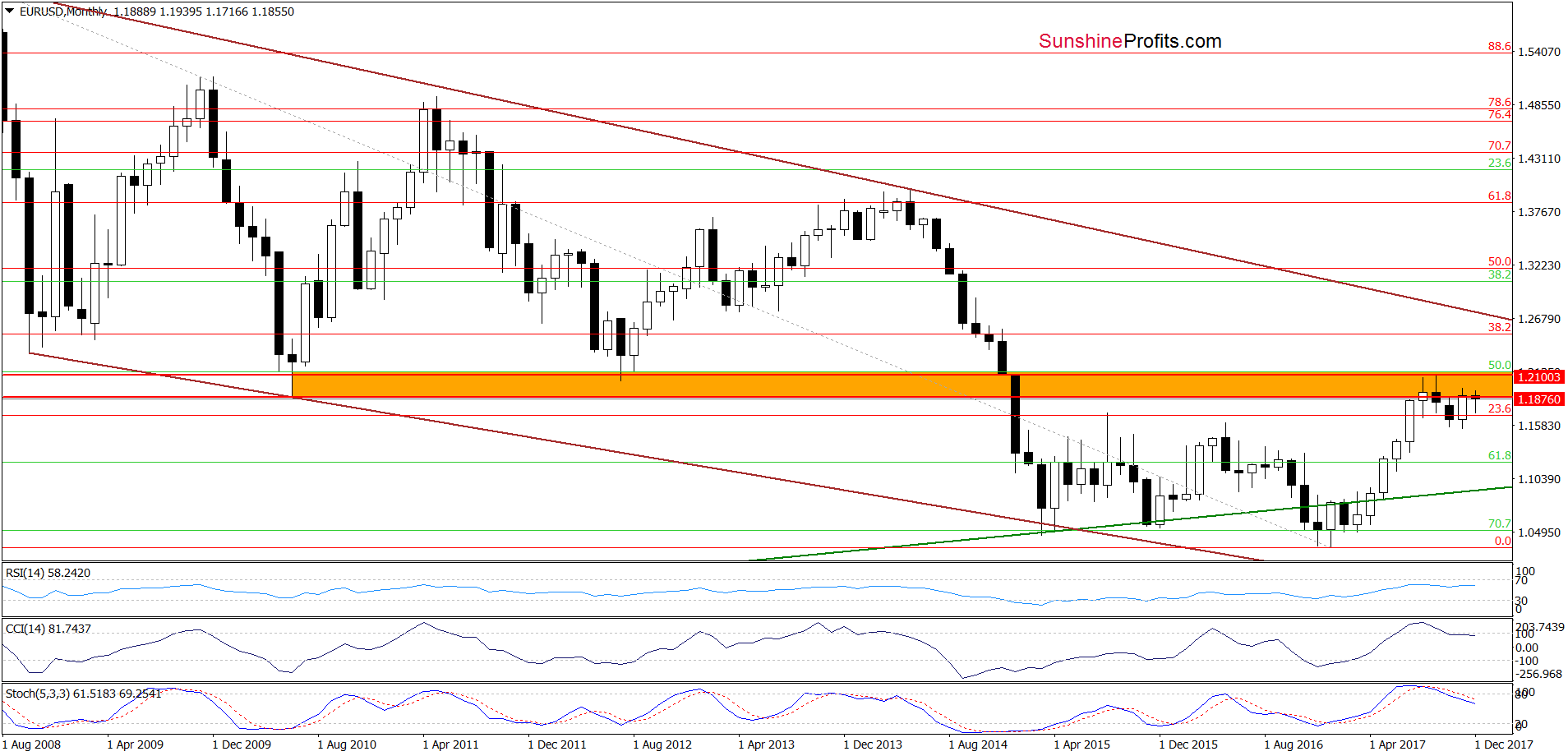

Although such price action looks quite positive, we should keep in mind that the CCI and the Stochastic Oscillator are very close to generating sell signals, which doesn’t bode well for further rally. Additionally, the exchange rate remains in the yellow consolidation under the orange resistance zone, which together with the sell signals generated by the weekly and monthly indicators (marked on the charts below) suggest that another move will be to the downside.

What does it mean for EUR/USD? In our opinion, if currency bears attack once again, we’ll likely see an invalidation of the Wednesday breakout above the upper line of the red declining trend channel. Such price action would be a bearish development, which should translate into further deterioration and a drop to around 1.1718, where the orange support line based on the previous lows currently is. Nevertheless, if this support is broken, the next downside target for the sellers will be the lower border of the trend channel in the following days.

Leave A Comment