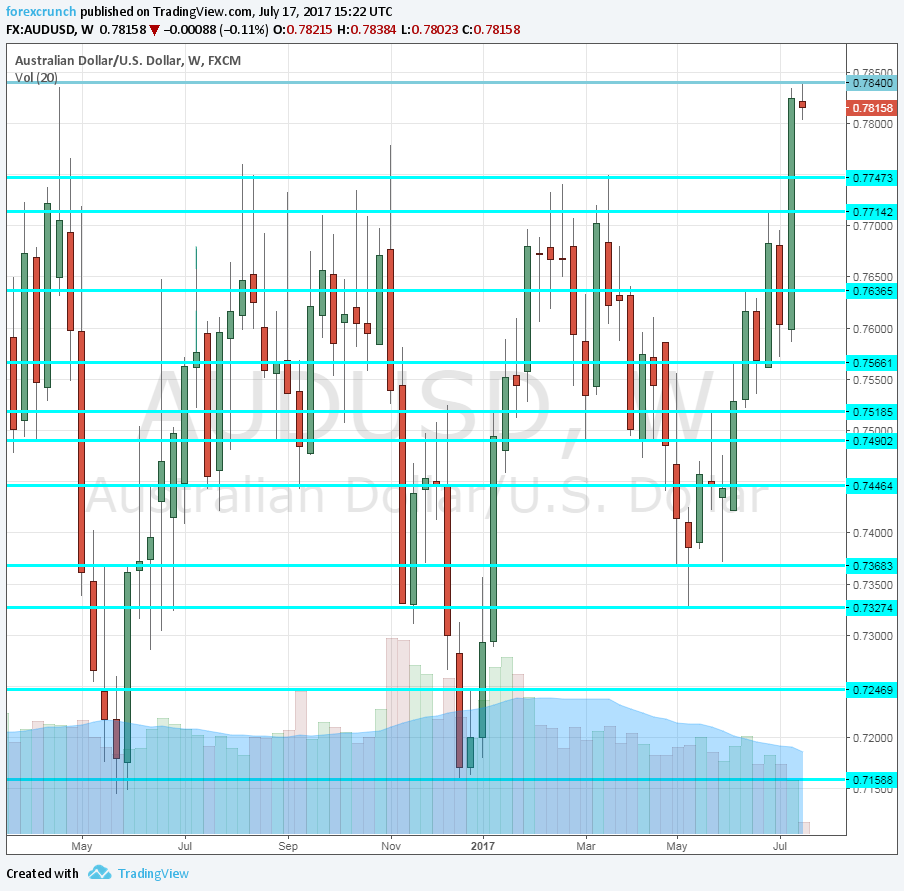

The Australian dollar has a good memory for old lines. The cycle high of 0.7840 was recorded back in April 2016. 15 months later, AUD/USD approaches this line very slowly but once it gets too close, it suddenly drops.

At least for now, Aussie/USD is rejected from this resistance line and forms a double-top. Will a second attempt succeed?

Chinese data, USD weakness help

China reported a growth rate of 6.9% annualized, better than 6.8% expected. More importantly, industrial output jumped more than predicted, and this certainly impacts Australia which exports metals to China’s industry.

In addition, USD weakness should help make the break. The travails of Donald Junior were joined by Yellen’s caution about inflation and the inflation data itself.

On the other side of the ring, we have Australia. As in the US, also the Australian central bank is hesitant and not eager to raise rates.

In this triangle of currencies, which one will have the upper hand? We may have to wait for the Australian jobs report, early on Thursday.

Leave A Comment