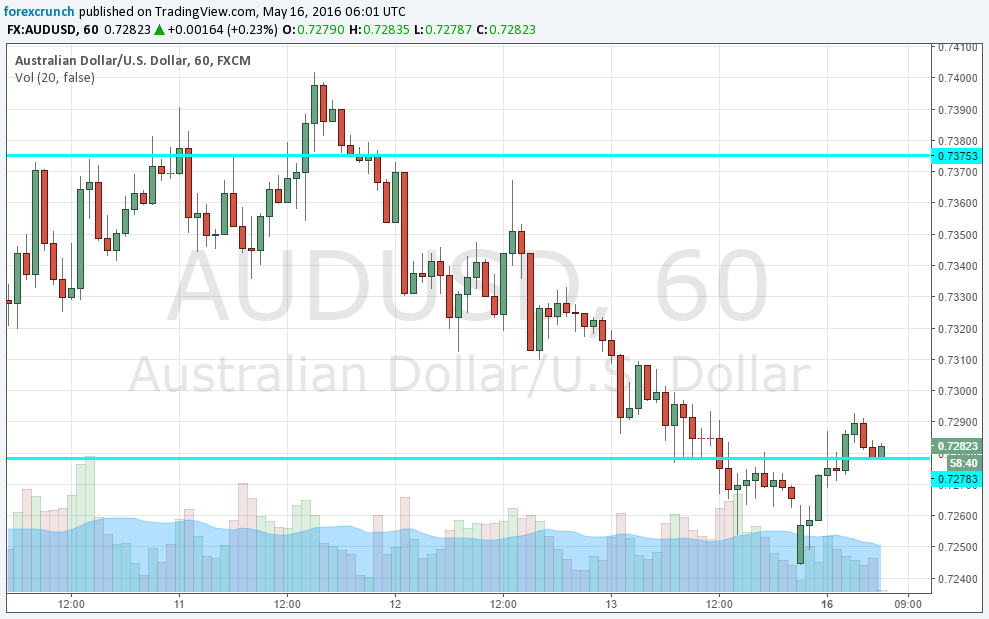

The Australian dollar has completed a drop of over 600 pips from the highs around resistance at 0.7840, opening the new trading week with a Sunday gap to 0.7244. While the pair managed to recover relatively quickly, there are reasons for weakness in the A$ in addition to the RBA’s one-two punch.

China, Australia’s No. 1 trade partner, releases a big bulk of data over the weekend, and it was all red on the economic calendar. Industrial output advanced by 6% y/y, worse than 6.8% seen last time and 6.5% expected. This is the most critical figure for the Australian dollar as it is best correlated with the Australian metals that China consumers.

Yet also the other figures fell short: Fixed asset investment advanced 10.5%, weaker than 11% expected and retail sales also missed with 10.1% against 10.6% predicted. So, China isn’t transitioning to consumption as quickly as desired.

AUD/USD opened with a clear weekend gap at 0.7244 but recovered relatively quickly. The big fall could also be the result of low liquidity at the beginning of the week. Nevertheless, the pair isn’t going anywhere fast: it is not recapturing the round 0.73 level that it settled on during last week.

More: RBA Not Finished Cutting Rates: Trading Renewed AUD Weakness – SocGen

Leave A Comment