AUD/USD posted modest gains last week, as the pair closed at 0.7572. This week’s key event is the RBA Monetary Policy Meeting Minutes. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

US consumer indicators disappointed, as CPI and retail sales reports missed their estimates. However, employment and consumer confidence beat expectations. In Australia, employment change sparkled, as the economy added 60 thousand jobs in February.

Updates

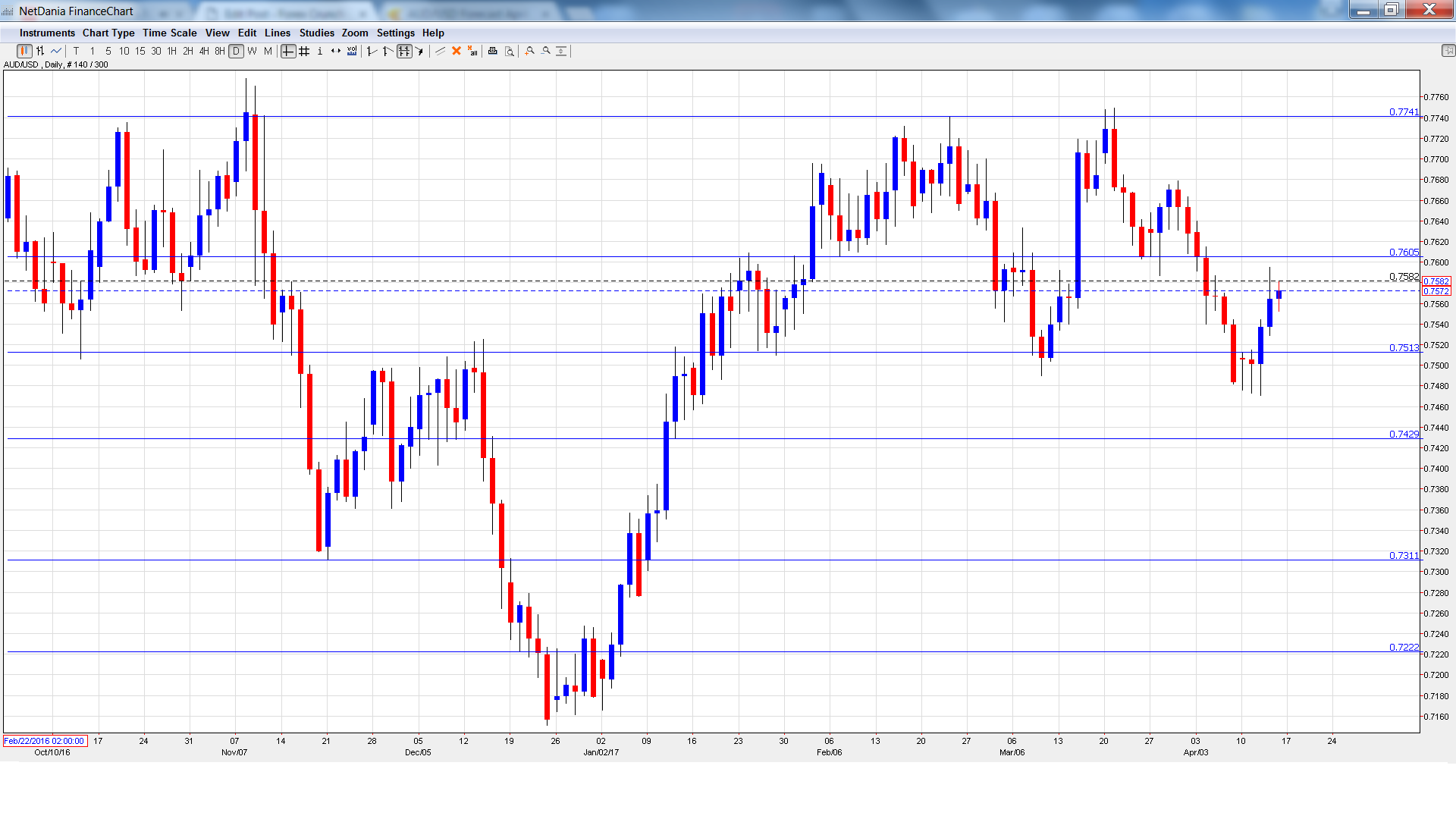

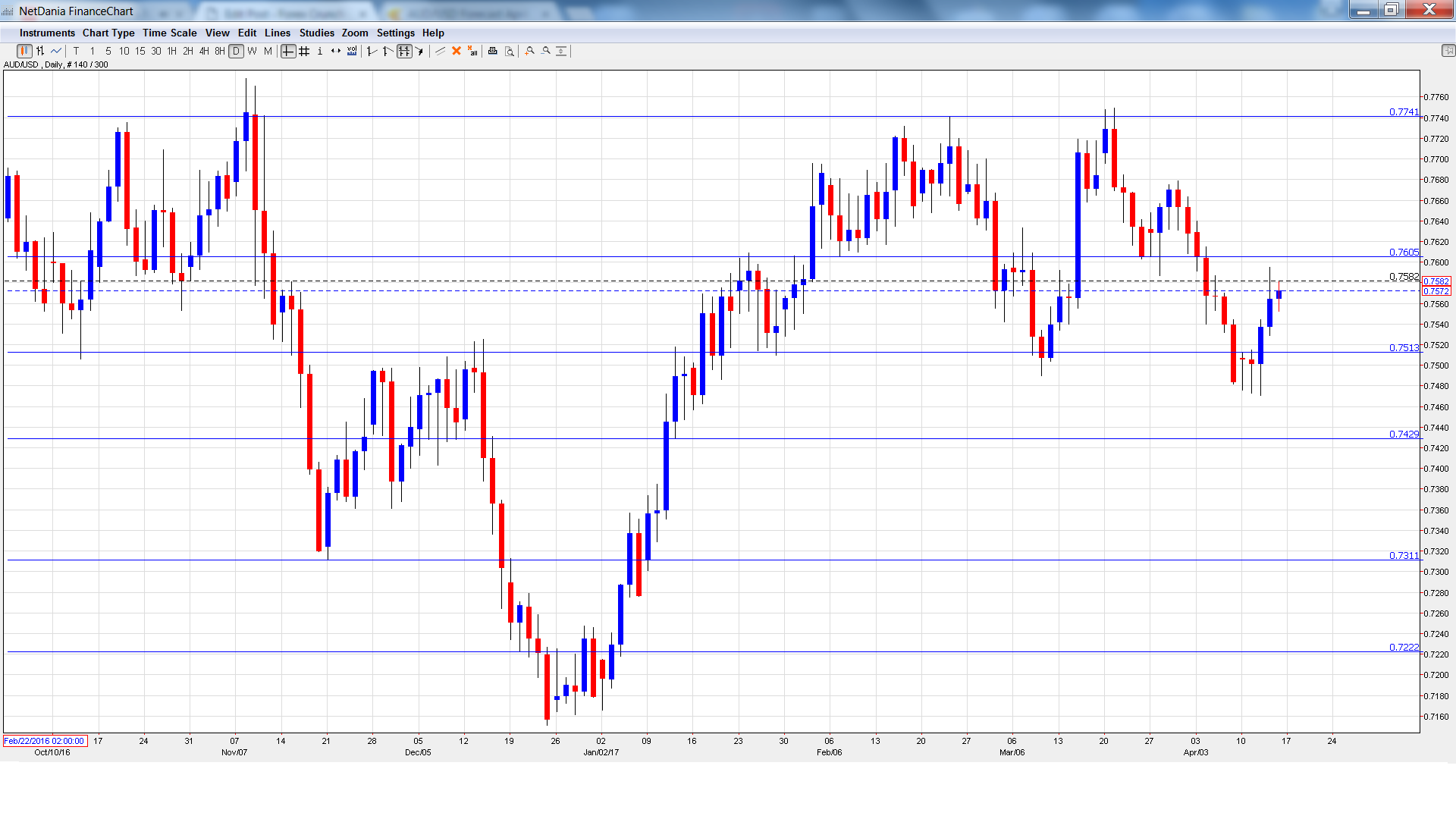

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

Chinese GDP: Monday, 2:00. Chinese key indicators can have a strong impact on the Australian dollar. Chinese GDP edged up to 6.8% in Q1, above the estimate of 6.7%. No change is expected in the Q2 report.

Chinese Industrial Production: Monday, 2:00. The indicator improved to 6.3% in February, beating the estimate of 6.2%. This marked the indicator’s strongest gain in five months. The estimate for the March report stands at 6.2%.

Monetary Policy Meeting Minutes: Tuesday, 1:30. The RBA will release the minutes of its March meeting, where the RBA held rates at 1.50%. The markets will be combing through the minutes, looking for clues as to future monetary policy.

CB Leading Index: Tuesday, 14:30. The indicator rebounded in January with a gain of 0.4%. Will the indicator post another gain in February?

MI Leading Index: Wednesday, 00:30. This index has been losing ground, and came in at -0.1% in February. This marked its first decline since June 2016.

New Motor Vehicle Sales: Wednesday, 1:30. This event is an important gauge of consumer spending. In February, the indicator dropped 2.7%, its sharpest decline since October 2015.

NAB Quarterly Business Confidence: Thursday, 1:30. Business confidence is linked to spending and hiring, so the indicator should be treated as a market-mover. The indicator unchanged at 5 points in Q1, indicative of optimism in the business sector.

Leave A Comment