The Australian dollar fell on fears of trade wars and ahead of the Fed decision. The upcoming week features important events from Australia: the jobs report and also the RBA meeting minutes. Will the pair recover? Here are the highlights of the week and an updated technical analysis for AUD/USD.

Chinese industrial output rose by 7.2% in February, much better than expected and an encouraging sign for Australia. However, Trump’s ongoing push for tariffs and the fear of trade wars weighed on the Australian dollar, a risk asset. The upcoming Fed decision also pushed the greenback higher.

Updates:

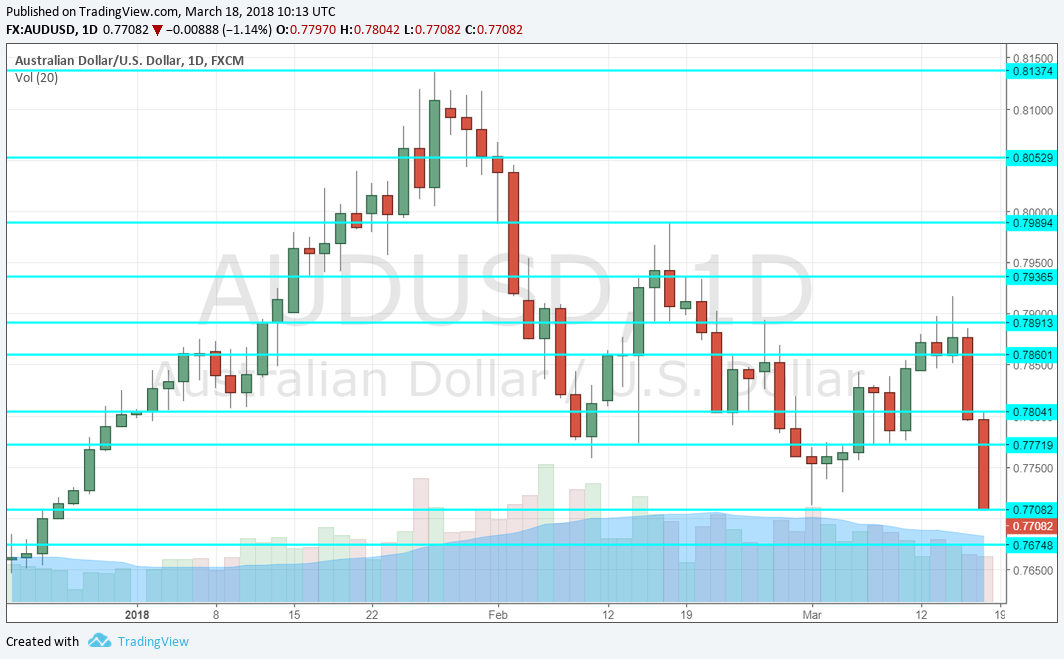

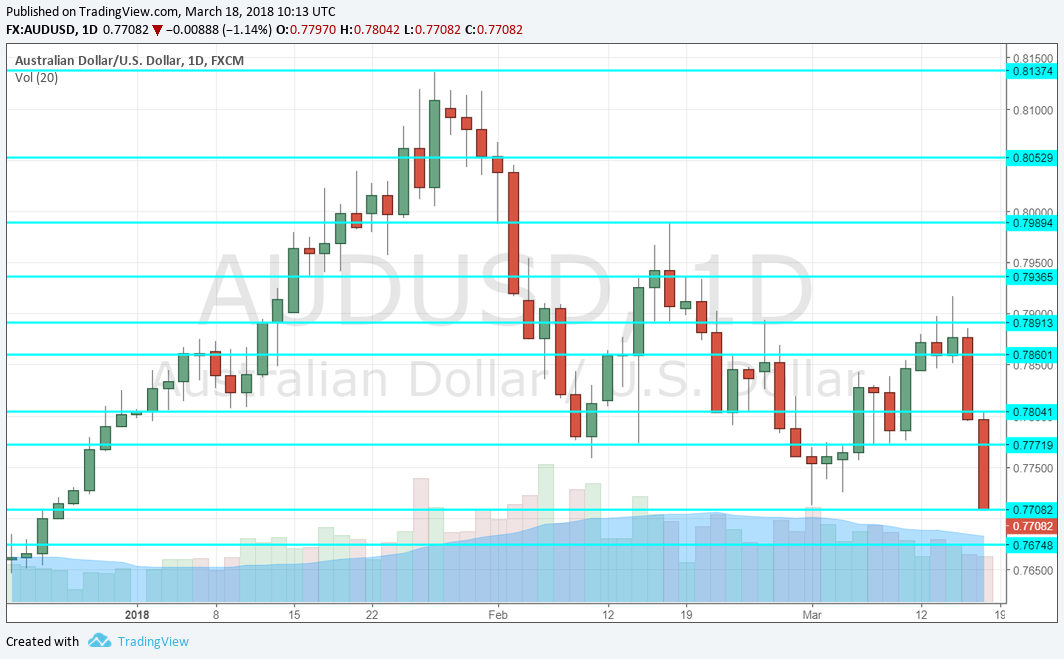

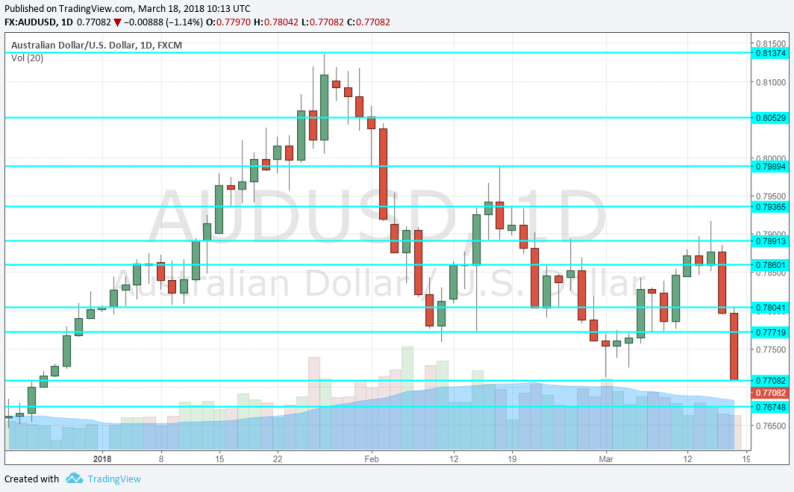

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

CB Leading Index: Monday, 14:30. The Conference Board’s composite index has shown a decline of 0.3% in the economy in December. We’ll now get the first figure for 2018.

Monetary Policy Meeting Minutes: Tuesday, 00:30. These are the minutes from the March decision in which the RBA left the interest rates unchanged as expected with a balanced tone. The minutes may reveal how worried the team led by Phillip Lowe is worried about growing household debt and wages and what they see in the global economy.

HPI: Tuesday, 00:30. Housing remains a worry in Australia after prices ballooned, especially in Sydney. In Q3, the HPI dropped by 0.2% and a small rise of 0.1% is projected in Q4 2018. The official figure may also point to a drop.

Michele Bullock talks Tuesday, 4:15. The RBA Assistant Governor for Financial Markets will speak about technology in Sydney and may also refer to monetary policy.

MI Leading Index: Tuesday, 23:30. The Melbourne Institute’s composite index has a shown a slide of 0.2% in its gauge for the Australian economy, similar to the figure published by the CB. A similar number is likely now.

Australian jobs report: Thursday, 00:30. In January, Australia reported a small rise in employment, 16K, within expectations but below the levels seen in previous months. The unemployment rate stood at 5.5%. While the job market looks good, policymakers are becoming worried about slow rises in wages and household debt. A tightening of the labor market will help relieve these worries and push the Aussie higher. A gain of 20.3K positions is on the cards and the unemployment rate carries expectations for 5.5%.

Leave A Comment