AUD/USD posted losses for a second straight week, closing at 0.7485. This week’s key event is the RBA Rate Statement. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

It was a disappointing week in the US. GDP grew by an annualized rate of 0.7% in the first quarter, weaker than expected and the lowest in three years. As well, durable goods orders and consumer confidence missed expectations.

Updates:

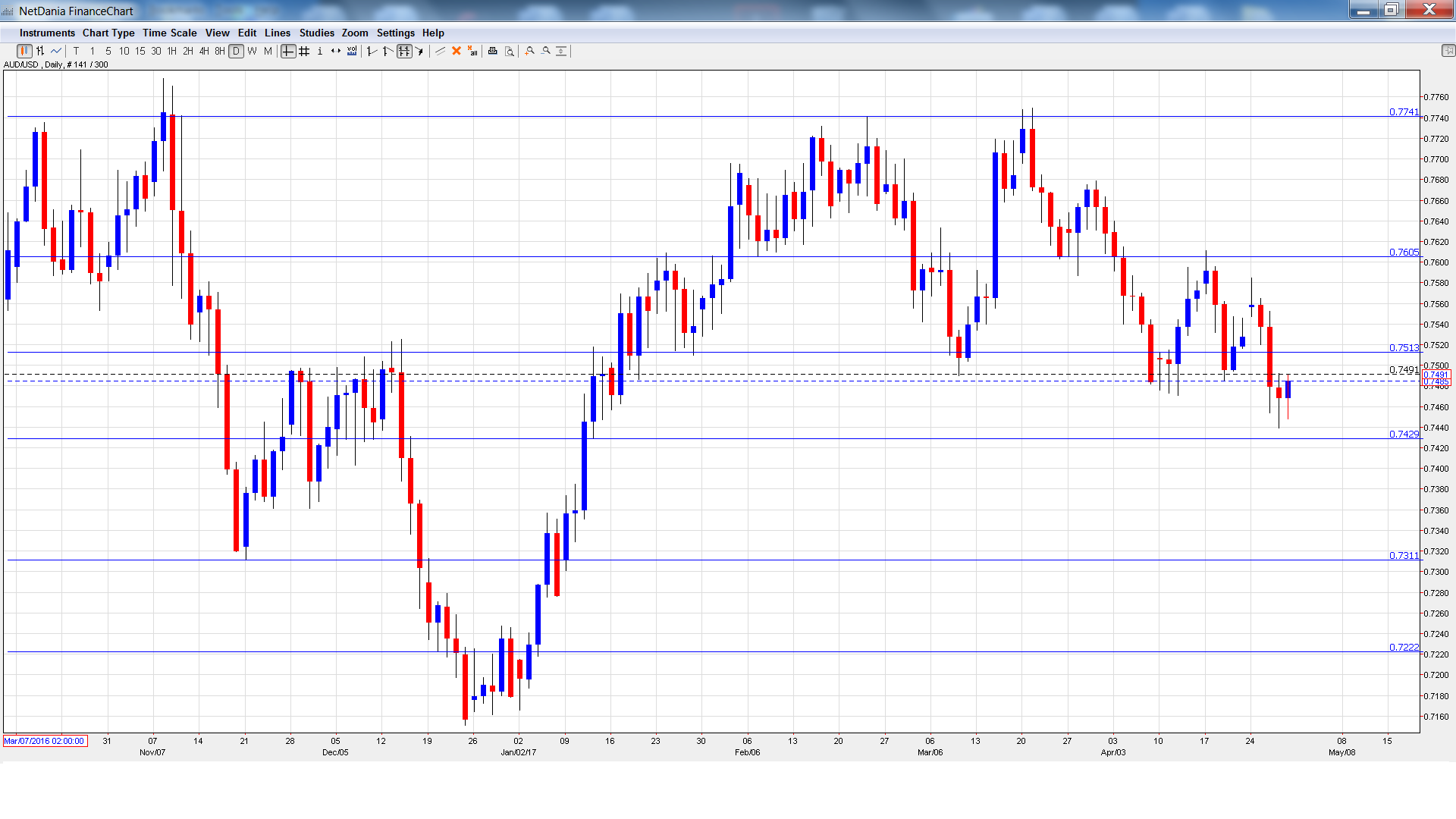

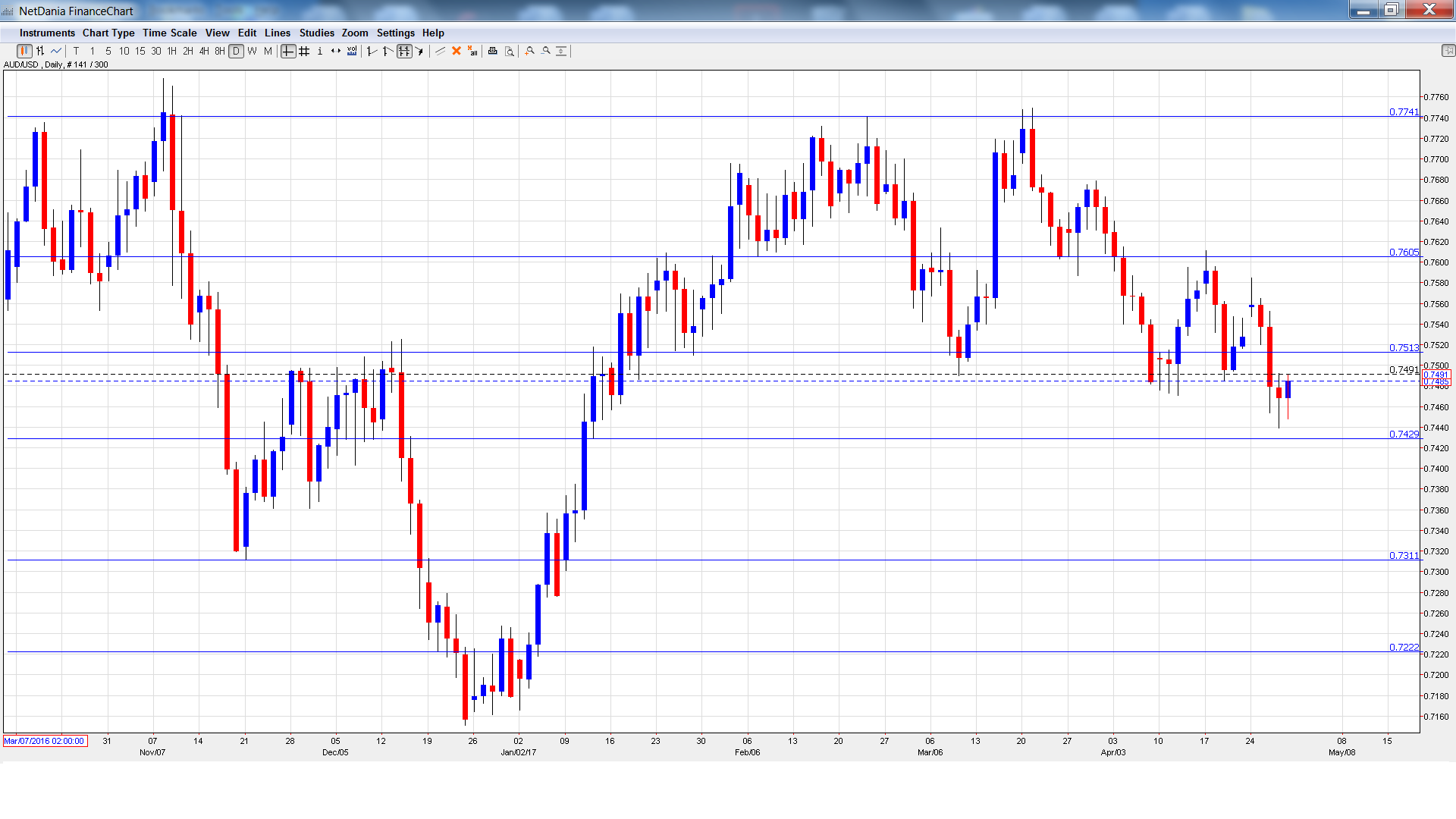

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

AIG Manufacturing Index: Sunday, 23:30. This minor indicator continues to show expansion, but dipped to 57.5 in March.

MI Inflation Gauge: Monday, 1:00. This monthly indicator helps analysts predict CPI, which is released on a quarterly basis. The index posted a small gain of 0.1% in March.

Commodity Prices: Monday, 6:30. Commodity prices have posted strong gains in Q1. In March, the indicator came in at 50.1%, down from 56.0% a month earlier.

Chinese Caixin Manufacturing PMI: Tuesday, 1:45. This Chinese indicator continues to show slight expansion. In March, the index dipped to 51.2, short of the estimate of 51.8 points. Little change is expected in the August report.

RBA Cash Rate: Tuesday, 4:30. The RBA will release its rate statement, with the RBA expected to hold rates at 1.50%. The rate has been pegged at this level since August 2016.

AIG Services Index: Tuesday, 23:30. The indicator rebounded in March, with a reading of 51.7 points. This points to slight expansion in the services sector.

HIA New Home Sales: Thursday, 1:00. This indicator provides a gauge of the level of activity in the housing sector. The indicator rebounded in February, with a slight gain of 0.2%.

Trade Balance: Thursday, 1:30. Australia’s trade surplus jumped to AUD 3.57 billion in February, well above the forecast of AUD 1.75 billion. The estimate for the March report is AUD 3.33 billion.

RBA Governor Philip Lowe Speech: Thursday, 3:10. Lowe will deliver remarks at an event in Brisbane. A speech which is more hawkish than expected is bullish for the Australian dollar.

AIG Construction Index: Thursday, 23:30. The indicator dipped to 51.2 in March, pointing to slight expansion in the construction sector.

RBA Monetary Policy Statement: Friday, 1:30. This quarterly report discusses the RBA’s view of economic conditions and inflation. Analysts will be looking for clues as to future monetary policy.

Leave A Comment