The Australian dollar was hit by an unimpressive job report and disappointing Chinese GDP. What’s next? Apart from rising and falling with the woes of stock markets, speeches by several RBA officials will rock the Aussie. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia gained only 5.6K positions in September, worse than had been expected. And while the unemployment rate fell to 5%, it was only thanks to a slide in the participation rate. China, Australia’s No. 1 trading partner, grew at an annualized rate of 6.5%, also below expectations, and raising concerns for the broader global economy. The Australian Dollar ended the weak on the slightly lower ground but never went too far.

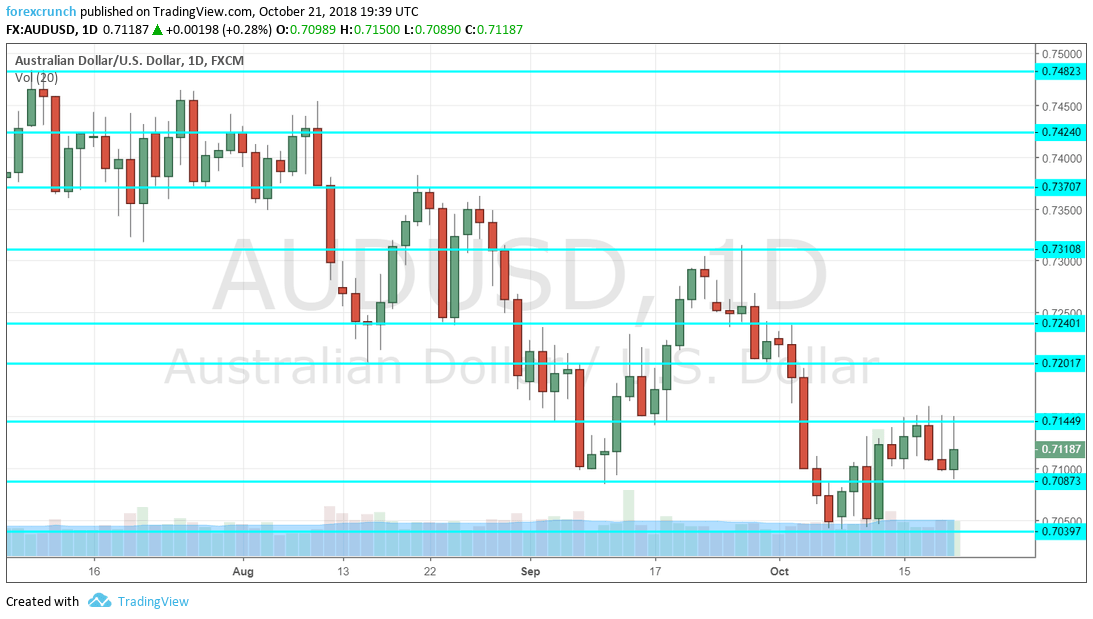

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD traded around the 0.7150 level (mentioned last week) but could not conquer it.

Technical lines from top to bottom:

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

Leave A Comment