The Australian dollar reached new lows but managed to recover as the market mood improved. What’s next? The RBA Meeting Minutes stand out. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia enjoyed a gain of 44K jobs in August, nearly triple the expectations. Another boost to the Aussie came from the trade war front. The US has not imposed new tariffs on China and negotiations have resumed. Do the talks have a fair chance? This is still to be seen, but at the moment, markets are up and the A$ rides the wave.

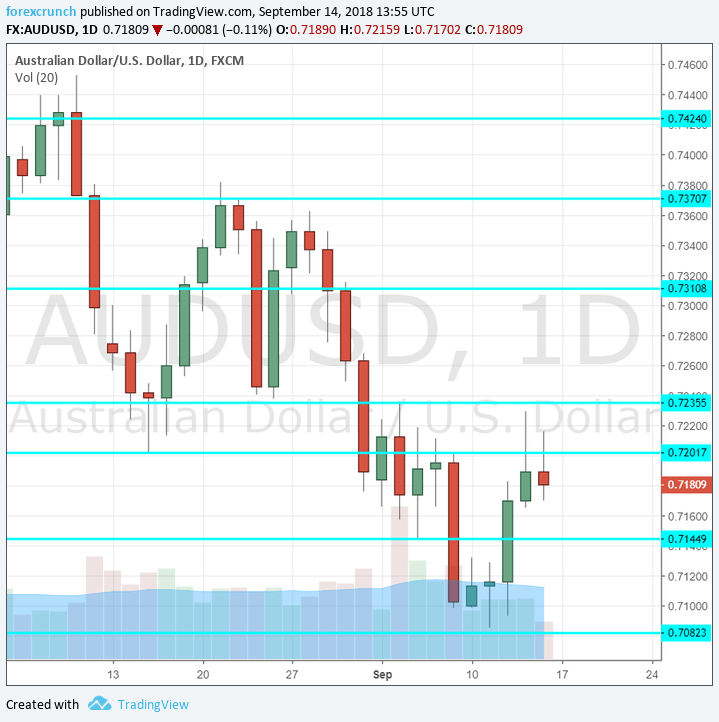

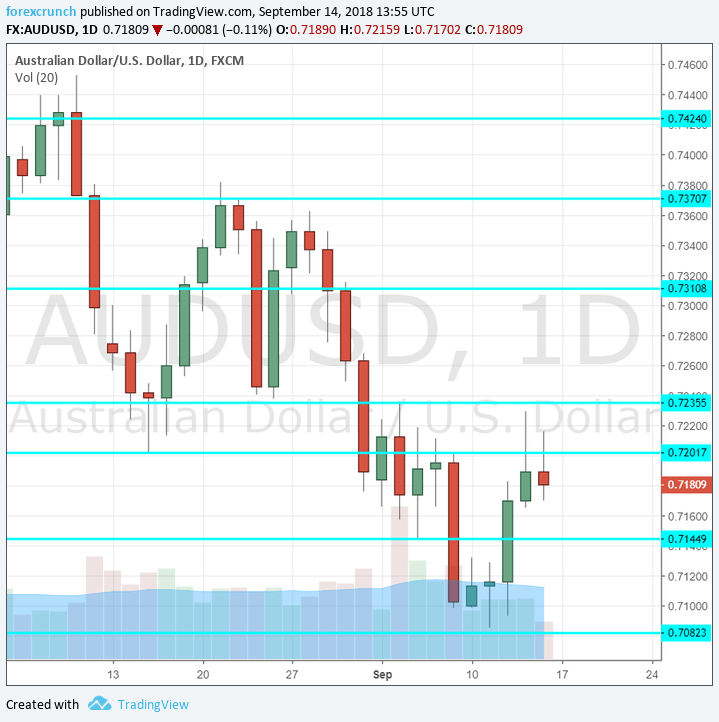

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

CB Leading Index: Monday, 2:30. The Conference Board’s composite index is comprised of 7 separate indicators, some of them already published. The indicator advanced by 0.2% in June and will likely enjoy a similar increase in July.

Monetary Policy Meeting Minutes: Tuesday, 1:30. The Reserve Bank of Australia left interest rates unchanged in its recent September meeting and did not adopt a dovish stance, contrary to the RBNZ. The meeting minutes will shed some light on the deliberations within the Canberra-based institution.

HPI: Tuesday, 1:30. This official measure of house price fell by 0.7% in the first quarter of 2018. While house prices are volatile even on a quarterly basis, a second consecutive quarter of declines will be worrying. A drop of 0.7% is on the cards.

MI Leading Index: Wednesday, 00:30. The Melbourne Institute uses no less than nine economic gauges for its composite measure. The gauge remained flat in July.

Christopher Kent talks: Wednesday, 1:30. The RBA’s Assistant Governor delivers a speech in Sydney and about the creation of money. Any comments about the economy or changes in money creation will be of interest.

RBA Bulletin: Thursday, 1:30. The quarterly report by the RBA is a long document including various statistics about the economy. The outlook for future developments is of interest.

Leave A Comment