Earlier today, currency bears took pushed the Australian dollar sharply lower against the greenback, which resulted in a fresh 2018 low in AUD/USD. Does this deterioration mean that the road to the south is wide open?

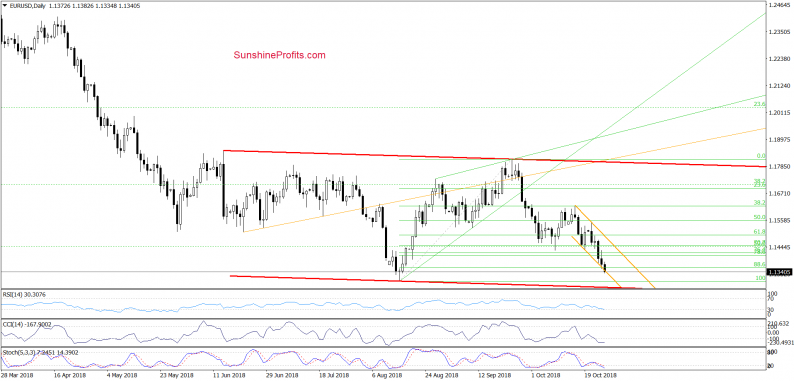

EUR/USD vs. Channel

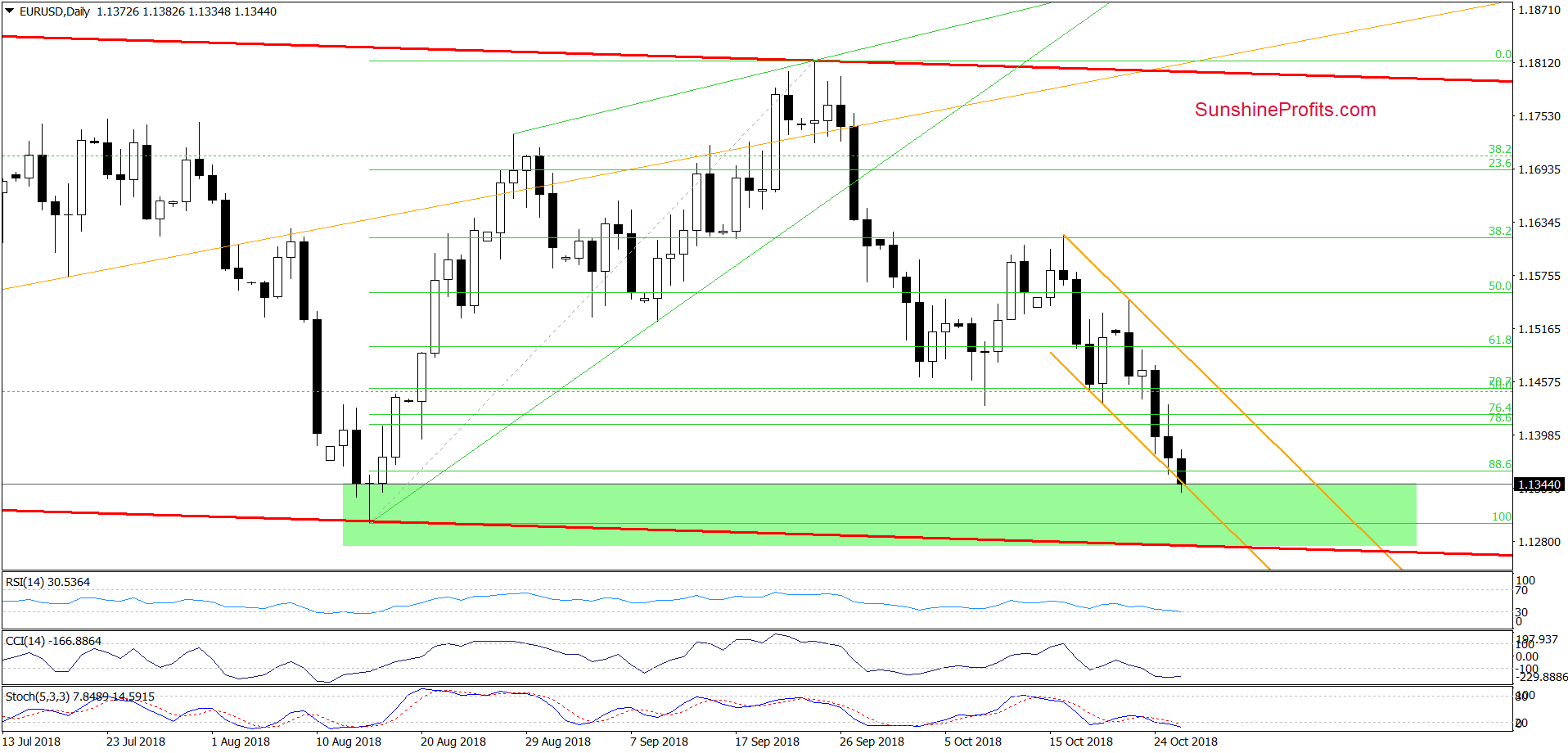

From today’s point of view, we see that currency bears pushed EUR/USD lower, which resulted in another test of the border of the very short-term orange declining trend channel earlier today.

Thanks to this drop, the pair also slipped to the green support zone based on August lows, which in combination with the lower border of the red declining trend channel (seen more clearly on the first daily chart) and the current position of the indicators suggests that the space for declines may be limited in the short term.

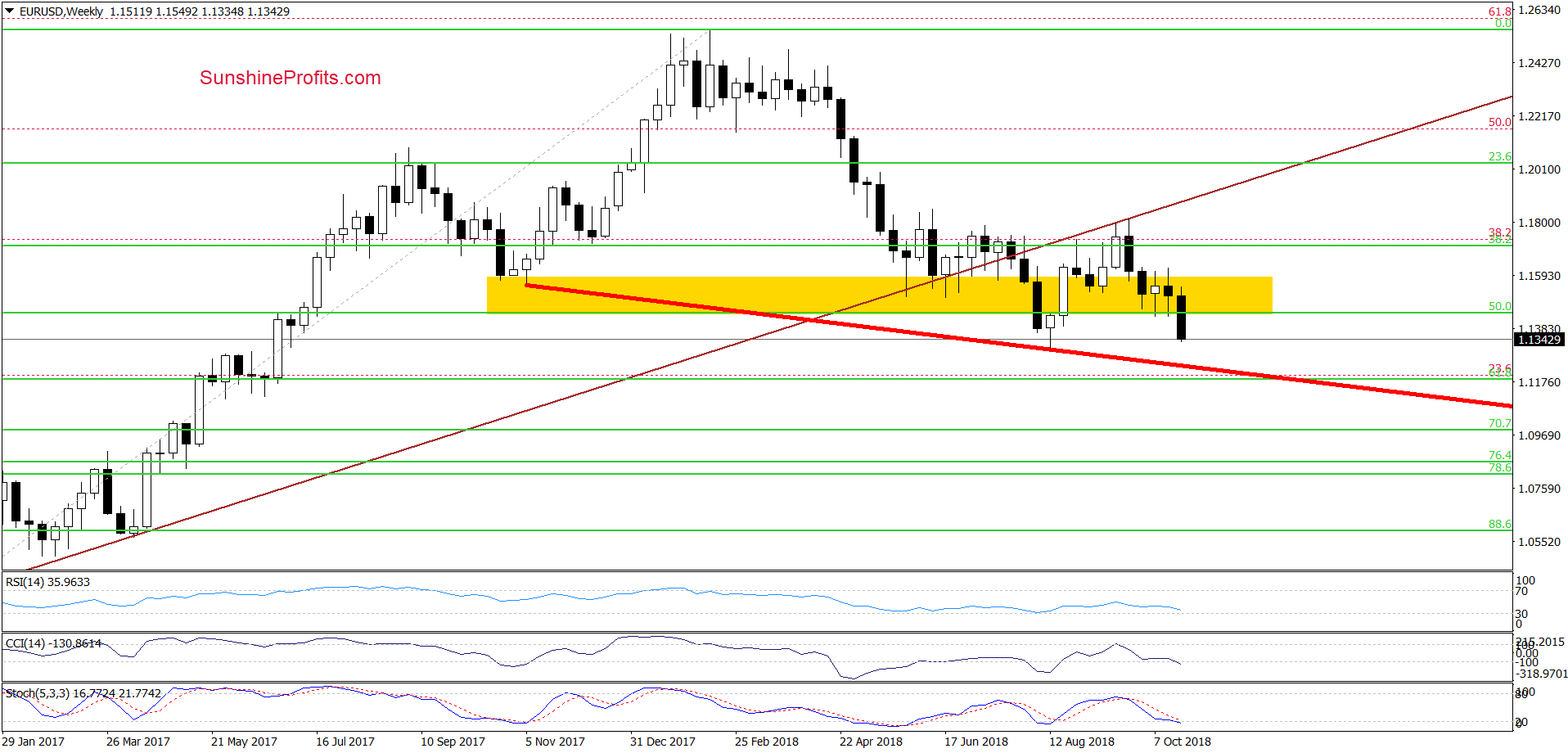

Nevertheless, if the exchange rate declines under the long-term red support line marked on the weekly chart below, the way to the lower values of EUR/USD will be open.

Why? Because the above-mentioned support line could be the neck line of the head and shoulders top formation, which increase its importance for both the bulls and the bears.

USD/JPY Re-tests Short-term Support

Looking at the daily chart, we see that USD/JPY declined in recent days, which resulted in a drop below the brown support line based on the August and September lows during yesterday’s session.

As you see this deterioration was temporary and currency bulls took the pair higher in the following hours. Despite this rebound, their opponents triggered another move to the downside and the exchange rate re-tested the strength of the above-mentioned support earlier today.

Similarly to what we saw yesterday, the buyers pushed USD/JPY above the brown line, which suggests that further improvement may be just around the corner. If this is the case and the pair rebounds from here, we’ll see an increase to (at least) 113.40 in the coming week.

Leave A Comment