– Reserve Bank of Australia (RBA) to Keep Official Cash Rate at Record-Low of 1.50%.

– Has the RBA Hit the End of Its Easing-Cycle?

Trading the News: Reserve Bank of Australia (RBA) Interest Rate Decision

More of the same from the Reserve Bank of Australia (RBA) may produce another limited reaction in AUD/USD, but a shift in the monetary policy outlook may fuel the near-term advance in the aussie-dollar exchange rate should Governor Philip Lowe and Co. show a greater willingness to gradually move away from the accommodative policy stance.

What’s Expected:

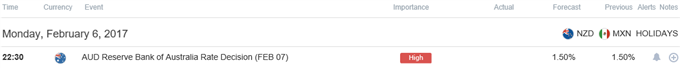

Click Here for the DailyFX Calendar

Why Is This Event Important:

After delivering two rate-cuts in 2016, the RBA may continue to soften its dovish tone as higher commodity prices are ‘providing a boost to national income’ and improves Australia’s terms of trade. In turn, the fresh batch of central bank rhetoric may heighten the appeal of the aussie should Governor Lowe curb speculation for additional monetary support, but the first interest rate decision for 2017 may generate a lackluster response should the RBA keep the door open to further insulate the real economy.

Expectations: Bullish Argument/Scenario

Release

Expected

Actual

Trade Balance (AUD) (DEC)

$2.000B

$3.511B

Consumer Price Index- Trimmed Mean (YoY) (4Q)

1.6%

1.6%

Employment Change (DEC)

10.0K

13.5K

Signs of sticky price growth paired with the record trade surplus may encourage the RBA to adopt an improved outlook for the region, and the Australian dollar may extend the advance from earlier this year should the central bank talk down expectations for additional monetary support.

Risk: Bearish Argument/Scenario

Release

Expected

Actual

Retail Sales (MoM) (DEC)

0.3%

-0.1%

Building Approvals (YoY) (DEC)

-10.8%

-11.4%

Gross Domestic Product s.a. (QoQ) (3Q)

-0.1%

-0.5%

Leave A Comment