CoreLogic’s Home Price Index (HPI) shows that home prices in the USA are up 5.5 % year-over-year (reported up 0.1 % month-over-month). CoreLogic HPI is used in the Federal Reserves’ Flow of Funds to calculate the values of residential real estate. The quote of the day was in this data release:

…. The rise in mortgage rates this summer to their highest level in seven years has made it more difficult for potential buyers to afford a home …

Analyst Opinion of CoreLogic’s HPI

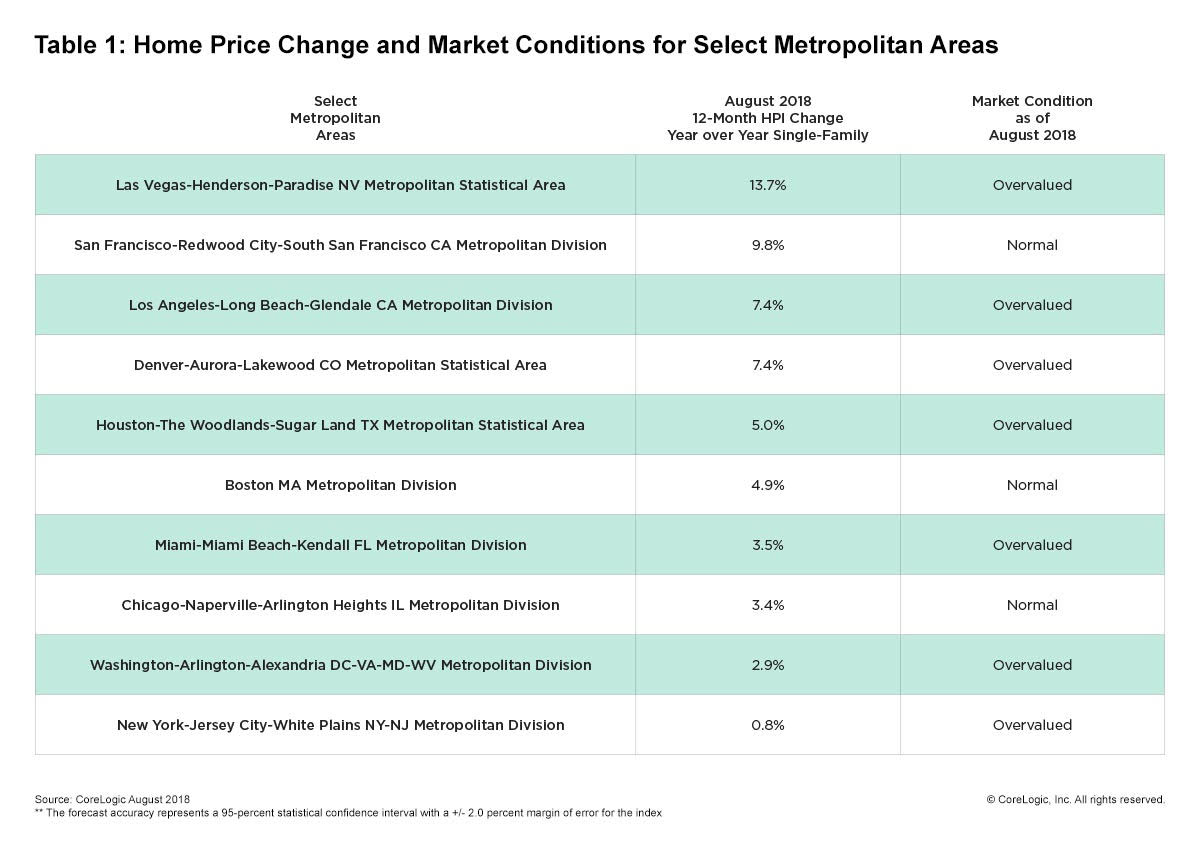

Home price averages seem to be averaging 6% year-over-year. According to CoreLogic:

…. revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results.

Note that CoreLogic forecasts:

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to continue to increase by 4.7 percent on a year-over-year basis from August 2018 to August 2019. On a month-over-month basis, home prices are expected to decrease by 0.4 percent from August to September 2018

Dr Frank Nothaft, chief economist for CoreLogic stated:

The rise in mortgage rates this summer to their highest level in seven years has made it more difficult for potential buyers to afford a home. The slackening in demand is reflected in the slowing of national appreciation, as illustrated in the CoreLogic Home Price Index. National appreciation in August was the slowest in nearly two years, and we expect appreciation to slow further in the coming year.

Frank Martell, president and CEO of CoreLogic stated:

In some markets, homebuyers and sellers are remaining cautious and taking a pause as price appreciation continues to rise. By waiting to sell, homeowners believe they will get the greatest return on their investment; the more money they have for a downpayment, the easier the purchase payments will be for their next home.

Caveats Relating to Home Price Indices

Leave A Comment