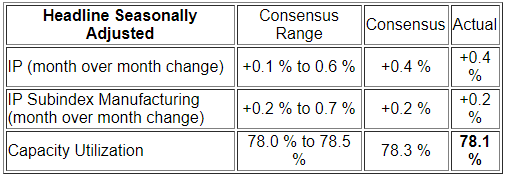

The headlines say seasonally adjusted Industrial Production (IP) improved month-over-month. Our analysis shows the three-month rolling averages declined.

Analyst Opinion of Industrial Production

There was a moderate downward revision to last month’s data. The best way to view this is the 3-month rolling averages which improved. Industrial production is in a long-term upward trend.

Manufacturing employment rate of growth is accelerating year-over-year…

IP headline index has three parts – manufacturing, mining, and utilities – manufacturing was up 0.2 % this month (up 3.1 % year-over-year), mining up 0.7 % (up 14.1 % year-over-year), and utilities were up 1.2 % (up 4.8 % year-over-year). Note that utilities are 10.8 % of the industrial production index, whilst mining also is 10.8 %.

Comparing Seasonally Adjusted Year-over-Year Change of the Industrial Production Index (blue line) with Components Manufacturing (red line), Utilities (green line), and Mining (orange line)

Unadjusted Industrial Production year-over-year growth for 2 years has been near or below zero – it is currently trending up and in an expansion.

Economic downturns have been signaled by only watching the manufacturing portion of Industrial Production. Historically manufacturing year-over-year growth has been negative when a recession is imminent.

Seasonally Adjusted Manufacturing Index of Industrial Production – Year-over-Year Growth

Leave A Comment