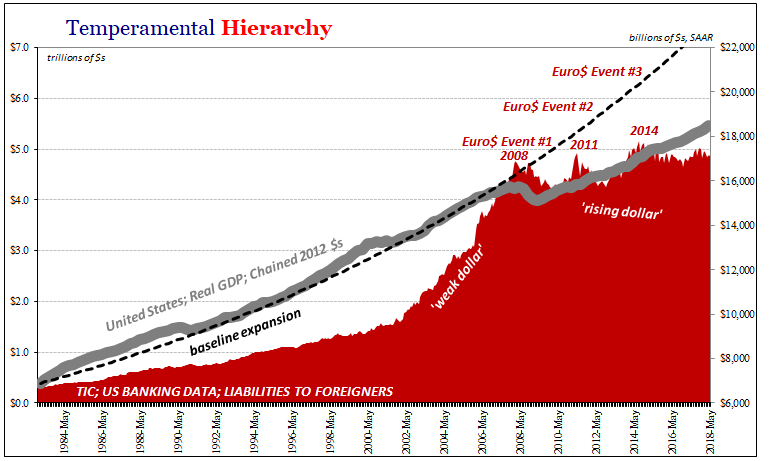

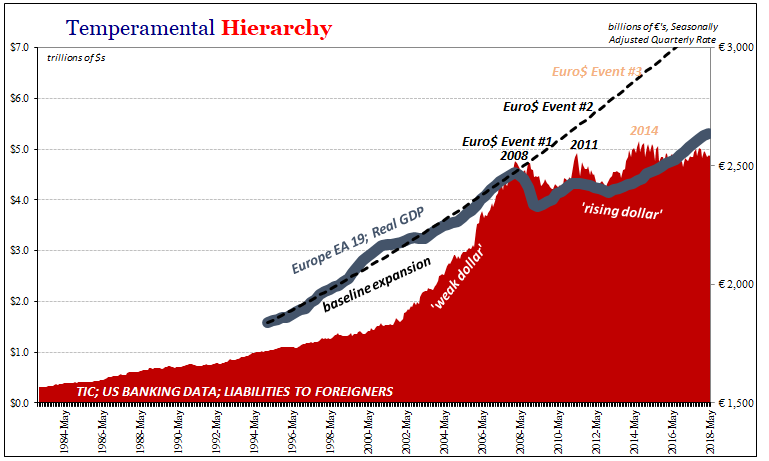

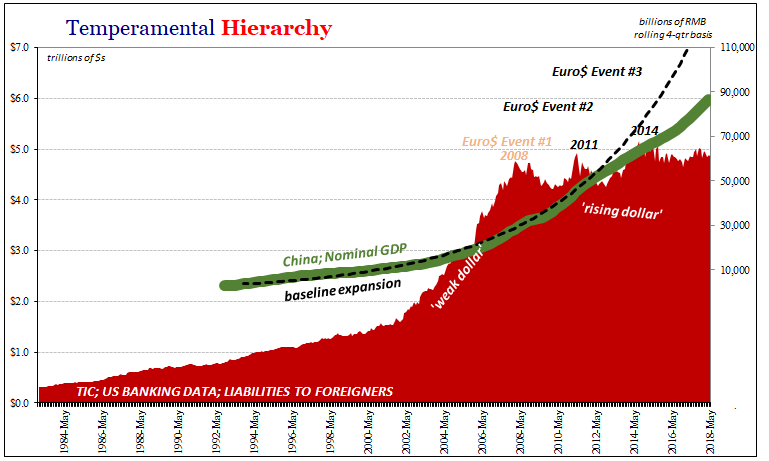

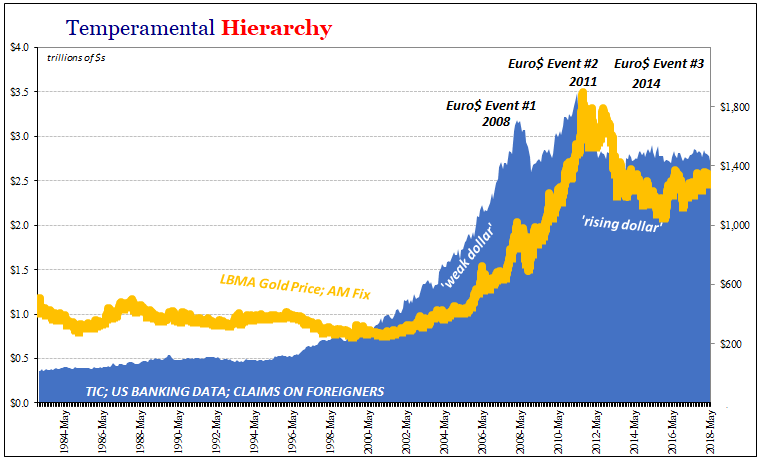

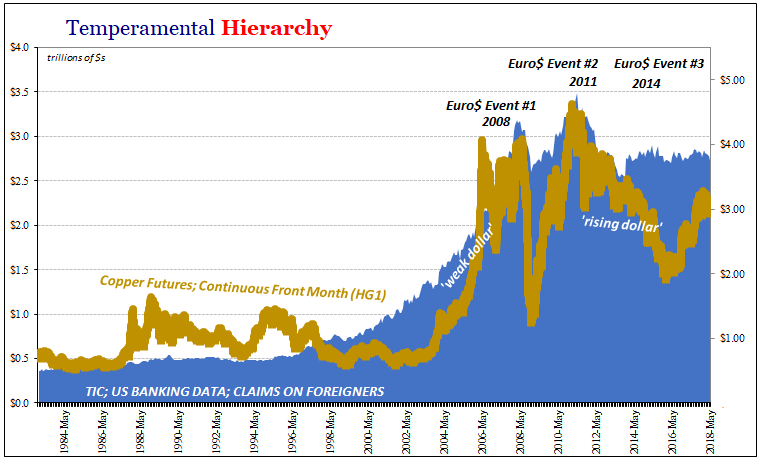

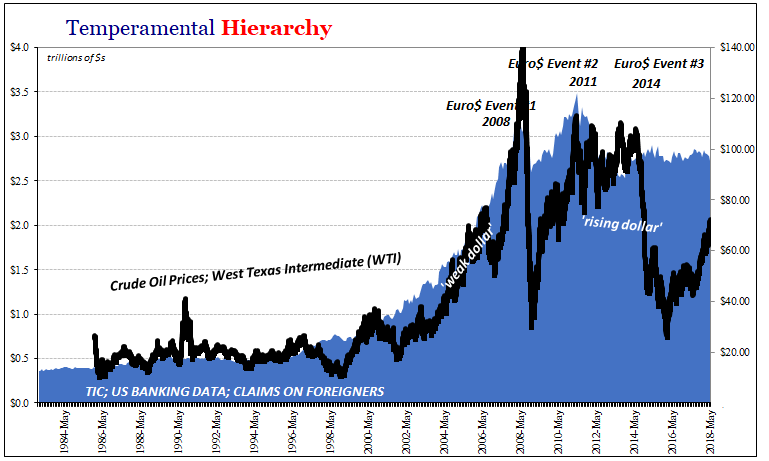

On August 9, 2007, the eurodollar system cracked. Over the eleven years since that day, the crack has only become enlarged. No amount of QE nor the bank reserves those produced has been able to patch the system back up into functioning condition. The thing lingers on, limping forward through small ups and more serious downturns. One step forward, two steps back for the global economy. The stress that creates has over the past few years really started to show.

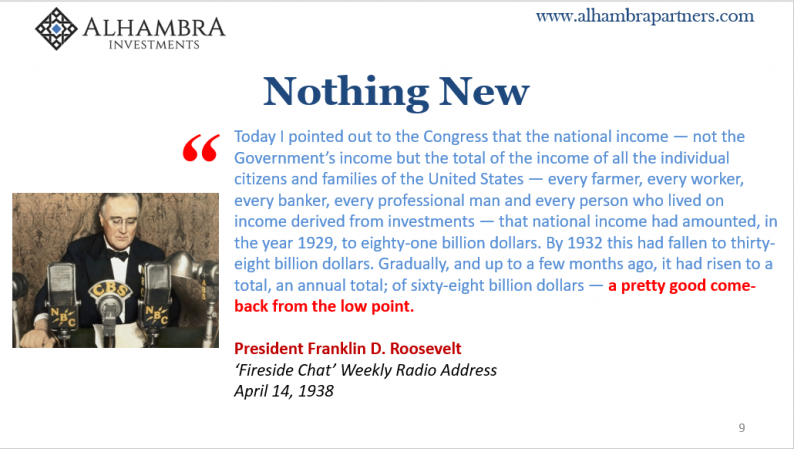

Not that you would know it by any kind of media commentary. The economy is doing really well, booming they say. Except like all of the so-called booms of the past eleven years, this is the repeating of a political trick. On April 14, 1938, FDR said:

No. This was political spin designed to mask a political admission. The economy wasn’t good nor booming. Instead, Roosevelt wanted Americans to make peace with good enough. The world couldn’t, and so there wouldn’t be peace.

That’s where we are again today. This purported boom isn’t like any in the past – except the one in the thirties. Calling this a boom is simply trying to get us to make peace with good enough. But it’s not good enough. Not even close.

To understand why, just to understand it, we still have to go back to 2008. It’s 2018 but we aren’t yet done with 2008. One lost decade runs into a second.

In remembering the significance of August 9, 2007, join MacroVoices and I for Season 2of Eurodollar University. In it, we try to make sense of why the system broke down and in such a way it could not be restarted. Why it wasn’t subprime mortgages, nor even credit risk. The role of systemic redundancies in how they transformed into monetary bottlenecks. What was OTTI and why it mattered so very much? Where was Ben?

Leave A Comment