Written by SmallCapPower.com

For more than a year now, the cannabis industry has been the hot topic for investors given the impending Canada marijuana legalization legislation in July 2018. Consequently, the current valuations for many of the cannabis stocks are high and the companies have much to prove. As most marijuana stock investors know, the top spot in the cannabis industry belongs to the incumbent Canopy Growth Corporation (TWMJF), which has taken advantage of its branding, early Health Canada approvals for sale and export, and a first-mover position in the market.

Today we will be comparing the current and future prospects of Aurora Cannabis Inc. (ACBFF) and Aphria Inc. (APHQF). These are the only two companies with the scope, scale, and differentiation to take on Canopy Growth. Each company produces marijuana differently and in different parts of the country, enabling them to better focus on gaining market share in their respective geographies.

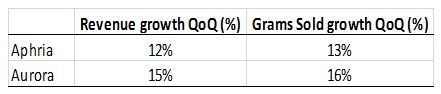

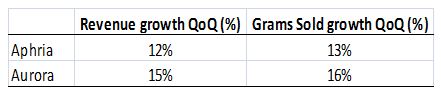

Quarter-to-Quarter Revenue Growth:

For these companies, revenue growth is the most significant factor and it is quickly reflected in stock prices as quarterly reports roll out.

For the most recent quarter, both companies have delivered healthy double-digit growth in terms of both revenue and grams sold. Both players registered high growth rates of over 40% in the preceding quarters, which has steadied in the most recent quarter, so investors can expect the steady state of growth to continue at least over the next few quarters, until the mid-2018 recreational legislation is implemented, when the growth rates may be drastically different and higher.

Production and Supply

There is currently a lack of supply in the industry. Additionally, the upcoming Canadian legalization of marijuana for recreational use in July 2018, will further drive demand. Both companies are ramping up their production facilities but there will be a period of time before these facilities can come online so it is important to understand the production profiles of these companies.

Leave A Comment