The Australian Dollar underperformed in overnight trade, sinking after the release of disappointing retail sales data. Receipts unexpectedly fell 0.1 percent in December, falling short of forecasts calling for a 0.3 percent gain and marking the first drop in five months.

The currency fell alongside front-end bond yields, hinting at a dovish shift in traders’ RBA outlook ahead of this week’s policy meeting. Governor Philip Lowe and company are expected to keep the cash rate unchanged at 1.5 percent but the accompanying statement may hint at where they intend to steer thereafter.

The Yen traded broadly higher as Japan’s benchmark Nikkei 225 stock index slumped after gapping higher at the weekly trading open. The New Zealand Dollar also gained ground, which may reflect bets on a hawkish pivot in official rhetoric after inflation hit a two-year high in the fourth quarter.

A quiet day on the European data docket will yield the spotlight to ECB President Mario Draghi, who is set to speak at the European Parliament. Comments on a slew of issues including Brexit, the impact of Donald Trump’s policies and the ECB’s dovish posture despite rising inflation may be on offer.

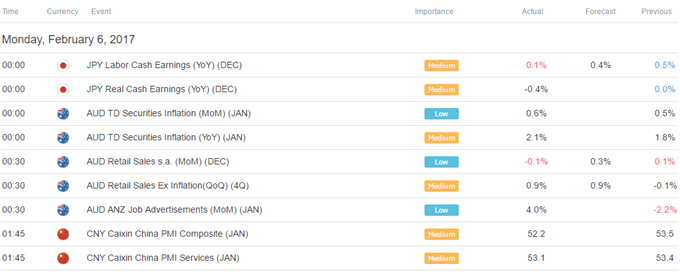

Asia Session

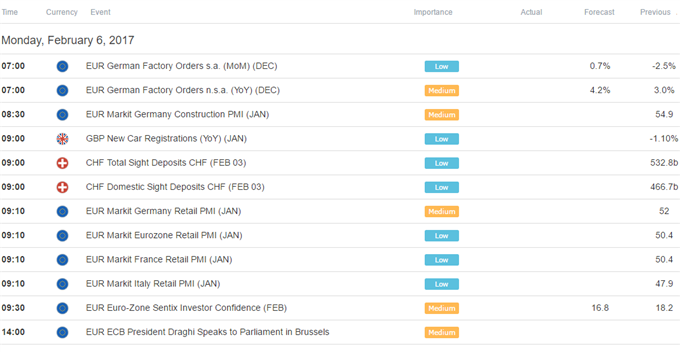

European Session

** All times listed in GMT. See the full DailyFX economic calendar here

Leave A Comment