In our previous commentary on the Australian dollar, we wrote that the ongoing bull market looks precarious despite benign global economic conditions. In particular, the currency is vulnerable thanks to high levels of household debt, limited consumer spending and the Reserve Bank of Australia’s neutral monetary policies. Following a significant sell-off in global equities and commodities earlier this month, the outlook for the Australian dollar is even weaker. As the bull market runs out of momentum, we downgraded our short-term outlook on the Australian dollar to neutral on February 7. The currency has traded sideways since that time. If current trends continue, we also expect to downgrade our medium-term outlook to neutral over the coming weeks. Today, we argue that global conditions are starting to move against AUD, while domestic conditions continue to weigh on the currency.

Global economic conditions turning less supportive

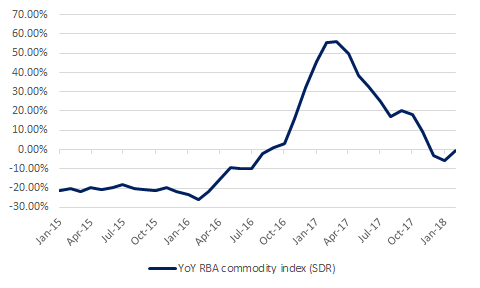

As a commodity currency, the Australian dollar is highly correlated with commodity prices. While global commodity indices such as the Dow Jones Commodity Index (DJCI) are a good way of looking at the sector as a whole, the RBA’s Index of Commodity Prices is a better measure of Australian commodity prices. Given the country’s unique geography, the RBA’s index includes a much heavier weighting for bulk commodities (51%), rural commodities (15%) and LNG (10%). An overview of the RBA’s Index of Commodity Prices is shown below. Note that the figures are expressed in rate-of-change terms.

Commodity boom in the rear view mirror

Source: Reserve Bank of Australia

As can be seen above, year-over-year changes in the RBA’s Index of Commodity prices have recently turned negative. While commodity prices shot up following a significant Chinese stimulus program at the outset of 2016, recent figures have been underwhelming. Historically, the Australian dollar has rallied alongside accelerating commodity prices. As upcoming figures for 2018 are likely to remain negative (primarily due to base effects), it is clear that the best days of bull market are in the rear view mirror.

Leave A Comment